On April 4, 2018, Mexco sold stock it held as an investment. It had a ($ 300,000)

Question:

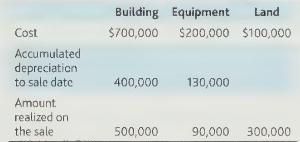

On April 4, 2018, Mexco sold stock it held as an investment. It had a \(\$ 300,000\) shortterm capital loss on the sale. It also sold a building, equipment, and the land under the building on July 1, 2018. Information about each asset is presented below. Mexco used MACRS depreciation on the equipment and straight-line depreciation on the building. Additionally, Mexco had a \$75,000 Code Sec. 1231 loss last year (and it has no Code Sec. 1231 gains or losses in previous years). Mexco did not sell any other assets this year. What are the tax results of the sale?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: