Refer to the facts in Problem 33 and assume that the straight-line method under the alternative MACRS

Question:

Refer to the facts in Problem 33 and assume that the straight-line method under the alternative MACRS system was elected over the MACRS recovery period for all the assets listed. Based on these facts, compute the 2019 and 2020 depreciation deductions for each of the assets listed. (Ignore bonus depreciation and the Section 179 deduction.)

Problem 33

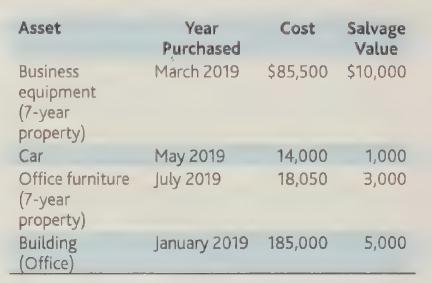

Compute MACRS depreciation for the following qualified assets for the calendar years 2019 and 2020: (Ignore bonus depreciation and the Section 179 deduction.)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: