Spencer Strank reports the following items of income for the current year on a joint return: He

Question:

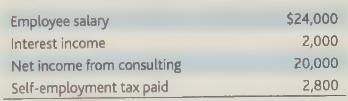

Spencer Strank reports the following items of income for the current year on a joint return:

He is a participant in his employer's qualified defined contribution retirement plan and has a nonworking spouse.

a. How much, if anything, may Spencer deduct if he contributes the maximum amount on behofa himlselff a nd his wife to a traditional IRA?

b. Same as (a), but AGI is $119,000.

What are the maximum contribution and deduction amounts available to Spencer if he maintains a Solo 401 (k) plan?

d. What are the maximum contribution and deduction amounts available to Spencer if he maintains a SEP IRA?

e. What are the maximum contribution and deduction amounts available to Spencer if he maintains a SIMPLE 401(k)?

Step by Step Answer:

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback