Bryce, a bank official, is 40 years old, unmarried and has no dependents. During 2022 he engages

Question:

Bryce, a bank official, is 40 years old, unmarried and has no dependents. During 2022 he engages in the following activities and transactions:

a. Being an avid fisherman, Bryce develops an expertise in tying flies. At times during the year, he is asked to conduct fly-tying demonstrations, for which he is paid a small fee. He also periodically sells flies that he makes. Income generated from these activities during the year is $2,500. The expenses for the year associated with Bryce’s fly-tying activity include $125 personal property taxes on a small trailer that he uses exclusively for this purpose, $2,900 in supplies, $270 in repairs on the trailer, and $200 in gasoline for traveling to the demonstrations.

b. Bryce sells a small building lot to his brother for $40,000. Bryce purchased the lot four years ago for $47,000, hoping to make a profit.

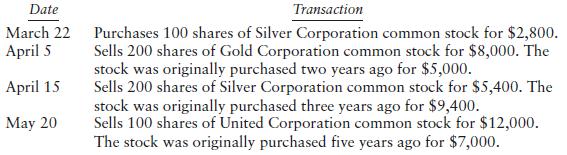

c. Bryce enters into the following stock transactions: (None of the stock qualifies as small business stock.)

d. Bryce’s salary for the year is $100,000. In addition to the items above, he makes $5,000 in cash contributions to Main Lutheran Church and pays $4,800 of state income tax. Determine the following:

1. Bryce’s taxable income for 2022.

2. Bryce’s basis in the Silver stock he continues to own.

Step by Step Answer:

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse