Mike and Linda are a married couple who file jointly and have $100,000 of taxable income. They

Question:

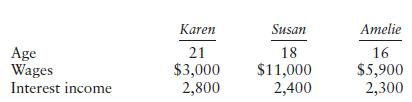

Mike and Linda are a married couple who file jointly and have $100,000 of taxable income. They have three dependent children who are full-time students in 2022. Mike and Linda provided $8,000 of support for each child. Information for each child is as follows:

Compute each child’s tax, assuming the interest income is taxable.

Transcribed Image Text:

Age Wages Interest income Karen 21 $3,000 2,800 Susan 18 $11,000 2,400 Amelie 16 $5,900 2,300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

Karens gross tax is 300 At age 21 Karen is subject to the kiddie tax because she is a fulltime stude...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted:

Students also viewed these Business questions

-

Mike and Linda are a married couple who file jointly. They have three dependent children who are full-time students in 2016. Mike and Lindas taxable income is $180,000 and they provided $8,000 of...

-

Mike and Linda are a married couple who file jointly. They have three dependent children who are full-time students in 2018. Mike and Linda provided $8,000 of support for each child. Information for...

-

Mike and Linda are a married couple who file jointly. They have three dependent children who are full-time students in 2019. Mike and Linda provided $8,000 of support for each child. Information for...

-

For rigid-body motion, the strains will vanish. Under these conditions, integrate the straindisplacement relations (7.6.1) to show that the most general form of a rigid-body motion displacement field...

-

If Idle v. City Co. is authority, to what extent?

-

The number of claims filed each week with Security Insurance Company has a mean of 700 and a standard deviation of 250. Calculate the probability that the number of claims this week will be: (a)...

-

A pilot survey was conducted with thirty respondents to examine Internet usage for personal (nonprofessional) reasons. The following table contains the resulting data giving each respondent's sex...

-

Cash budgeting, chapter appendix. On December 1, 2009, the Itami Wholesale Co. is attempting to project cash receipts and disbursements through January 31, 2010. On this latter date, a note will be...

-

After watching the movie(Enron- the smartest guys in the room) and also the clip of Milton Friedman discussing Greed, what are your thoughts on the difference of "free markets" vs. regulations in...

-

Do you think Fiat and Tata make for good partners? Compare the Fiat-GM relationship with the Fiat-Tata relationship. What would you recommend for the alliance to be successful? Tata Motors and Fiat...

-

Georgia owns all of Peach Corporations stock. Peach pays her a $70,000 salary, which reduces its before-tax profit to $30,000. Peach distributes all of its after-tax income to its shareholder,...

-

Jim and Pat are married, file jointly, and have one dependent (12-year-old qualifying child). Jim receives a $92,000 salary. Pat is selfemployed. Her sole proprietorships revenues are $98,000, and...

-

Write a user-defined function that finds all the prime numbers between two numbers m and n. Name the function pr=prime (m, n), where the input arguments m and n are positive integers and the output...

-

Options Strategy: Using the readings and/or other sources (e.g., NUMA , CBOE , , etc.) select an option investing or hedging strategy for a foreign exchange currency, a single stock or equity index...

-

You own shares in the XYZ company. For the first 10 years that you owned the shares, they paid a dividend of$150 every 6 months(paid at the end of every 6months). However due to a downturn in the...

-

You have had the Game Plans signed by each client and the below is where each client/s wants to obtain finance from: Lender Client 1 BankSA Clients 2 Brunswick - AMP - cashback $3000 Fremantle -...

-

A company's degree of financial leverage (DFL) is 1.1.If it is currently selling 10,000 units its operating break-even point of 15,000 units, what is its degree of combined leverage (DCL) rounded to...

-

You purchase a bond on Oct. 15, 2022 which is scheduled to mature on May 15, 2027. If the bond has a yield of 2.28% and a coupon rate of 2.50%, what will be the invoice price (based on a face value...

-

Why is an emotional connection to a car brand so important?

-

Do the three planes x + 2x + x 3 = 4, X X 3 = 1, and x + 3x = 0 have at least one common point of intersection? Explain.

-

If a producer creates a really revolutionary new product and consumers can learn about it and purchase it at a website, is any additional marketing effort really necessary? Explain your thinking.

-

List your activities for the first two hours after you woke up this morning. Briefly indicate how marketing affected your activities.

-

Distinguish between the micro and macro views of marketing. Then explain how they are interrelated, if they are.

-

1) Use the following post-closing (i.e. beginning) trial balance to specify the beginning balances in the T-accounts on pages 3 and 4. The beginning balance for Cash is specified in the T-account...

-

Current Attempt in Progress These are selected account balances on December 31, 2025. Land $195000 Land (held for future use) 292500 Buildings 1560000 Inventory 390000 Equipment 877500 Furniture...

-

Module: Market Share Metrics 2 / Problem Set ID: 1044 es Spring 2024 All-over Shampoo is a leading brand in the company's western sales region. Of the 660,000 households in the region, 500,000...

Study smarter with the SolutionInn App