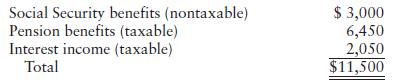

Caroline, age 66 and filing single as a dependent of another, received the following income items for

Question:

Caroline, age 66 and filing single as a dependent of another, received the following income items for the current year: Caroline’s tax liability (before credits) is $540.

Caroline’s tax liability (before credits) is $540.

a. What is Caroline’s tentative tax credit for the elderly (before the tax liability limitation is applied)?

b. What is Caroline’s allowable tax credit?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2023 Individuals

ISBN: 9780137700127

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted: