Scott and Lynn Brown each own 50% of Benson Corporation stock. During the current year, Benson made

Question:

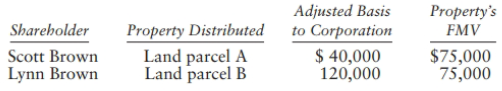

Scott and Lynn Brown each own 50% of Benson Corporation stock. During the current year, Benson made the following distributions to its shareholders:

Benson had E&P of $250,000 immediately before the distributions. Prepare a memorandum for your tax manager explaining how Benson should treat these transactions for tax and financial accounting purposes. How will the two shareholders report the distributions? Benson's tax rate is 21%. Your manager has suggested that, at a minimum, you consult the following resources:

? IRC Sec. 301

? IRC Sec. 311

? IRC Sec. 312

? Accounting Standards Codification (ASC) 845, formerly APB No. 29

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2019 Comprehensive

ISBN: 9780134833194

32nd Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: