Use the information shown below to prepare a 2017 gift tax return (Form 709) for Joel Bruton.

Question:

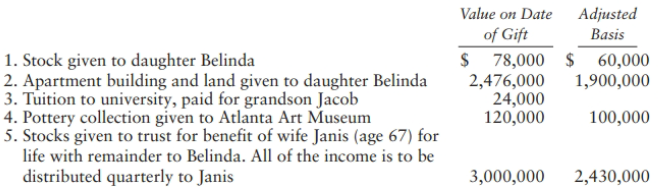

Use the information shown below to prepare a 2017 gift tax return (Form 709) for Joel Bruton. Pages 4 and 5 of the form are not applicable. Joel and his wife Janis, both U.S. citizens, want to elect gift splitting. They reside at 117 Panther Place, South City, NC 28000. Joel had not been married prior to his marriage to Janis in 1966. For simplicity, assume that the Sec. 7520 rate is 4%. Joel's transactions, all in July, are as shown below

During the year Janis gave $40,000 cash to Belinda and $200,000 of stock to her sister Jeanette Johnson. Janis had a $120,000 adjusted basis in the stock. Joel made a $1 million taxable gift in 2000. It was the first and only earlier gift.

Step by Step Answer:

Federal Taxation 2019 Comprehensive

ISBN: 9780134833194

32nd Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson