Analyze the dual trade to the third butterfly trade in Table 5.8. Thus go long a put

Question:

Analyze the dual trade to the third butterfly trade in Table 5.8. Thus go long a put at 80, short 2 puts at 75, and long a put at 70. Let the starting price be S0 = 70 and assume the drift is −2 %.

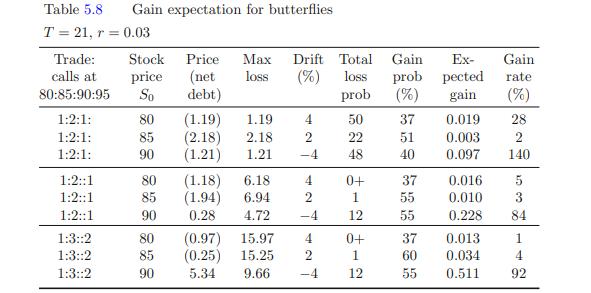

Data given in Table 5.8

Transcribed Image Text:

Table 5.8 T = 21, r= 0.03 Trade: Stock Price Max Drift Total Gain Ex- calls at price (net loss (%) loss prob pected 80:85:90:95 So debt) prob (%) 1:2:1: 1:2:1: 1:2:1: Gain expectation for butterflies 1:2::1 1:2:1 1:2:1 1:3::2 1:3::2 1:3::2 80 (1.19) 85 (2.18) 90 (1.21) 80 85 (1.94) 90 0.28 (1.18) 6.18 4 6.94 2 4.72 -4 1.19 4 50 2.18 2 22 1.21 -4 48 80 (0.97) 85 (0.25) 90 5.34 0+ 1 12 15.97 4 0+ 15.25 2 1 9.66 -4 12 37 51 40 37 55 55 37 60 55 Gain rate. gain (%) 0.019 28 0.003 2 0.097 140 0.016 0.010 0.228 0.013 0.034 0.511 5 3 84 1 4 92

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

The dual trade to the third butterfly trade in Table 58 is a long put at 80 short 2 puts at 75 and a long put at 70 This trade has a net debit of 119 a maximum loss of 2 and a drift of 2 To analyze th...View the full answer

Answered By

Ishrat Khan

Previously, I have worked as an accounting scholar at acemyhomework, and have been tutoring busines students in various subjects, mostly accounting. More specifically I'm very knowledgeable in accounting subjects for college and university level. I have done master in commerce specialising in accounting and finance as well as other business subjects.

5.00+

134+ Reviews

427+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

9. What will the following code print on the console? int main() { } int num = 4; cout < < (num & 3 == 0 ? "first" : "second"); return 0; a. second b. first c. There is a syntax error d. It will...

-

Southerns Pizza bought a used Nissan delivery van on January 2, 2010, for $19,200. The van was expected to remain in service four years (30,000 miles). At the end of its useful life, Southerns...

-

Steam expands in a turbine steadily at a rate of 40,000 kg/h, entering at 8 MPa and 500°C and leaving at 40 kPa as saturated vapor. If the power generated by the turbine is 8.2 MW, determine the...

-

Consider the derivation of Equation (4.5) for the sample size of a two-sample z-test with known variance and equal allocation. a. Identify terms in Equation (4.2) that are smaller than $\alpha / 2$...

-

Planning is one of the most demanding and important aspects of an audit. A carefully planned audit increases auditor efficiency and provides greater assurance that the audit team addresses the...

-

Image transcription text The simply supported 1 m long round shaft shown in the figure is subjected to a constant concentrated force of 200 N at the center of the shaft in two directions and a steady...

-

Show that if X P o ( 1 ) and Y P o ( 2 ), then X + Y P o ( 1 + 2 ). Pr(X + Y z) = Pr(X z-yY= y)Pr(Y = y) y=0 11 y=0 d e-site-re -1 (z - y)! y!

-

Using the parameters in the header of Table 5.5, investigate the effect on the gain rate of the 80/85 spread if the volatility: becomes 30 % just after the trade is established, becomes 10 % under...

-

What are some comparative advantages of investing in the following? a. Unit investment trusts. b. Open-end mutual funds. c. Individual stocks and bonds that you choose for yourself.

-

What are the two axioms that tell you which account to debit and which account to credit?

-

What is Girsanovs theorem?

-

Explain what the stack and roll hedging strategy involves.

-

How do (a) forward and (b) futures contracts trade?

-

Explain how basis risk arises in hedging.

-

Peck Company purchased Sanno Company common stock in a series of open-market cash purchases from 2009 through 2011 as follows: Sanno Company had 18,000 shares of $20 par value common stock...

-

Kims Konstructions has assembled the following data for a proposed straw-reinforced brick maker (SRBM): SRBM Cost: $26,000 Life: 5 years Revenue (p.a.) $11,000 Operating Expenses (p.a.) $3,000...

-

A particle starts from rest and accelerates as shown in Figure P2.12. Determine (a) The particles speed at t = 10.0 s and at t = 20.0 s, and (b) The distance traveled in the first 20.0 s.

-

Secretariat won the Kentucky Derby with times for successive quarter-mile segments of 25.2 s, 24.0 s, 23.8, and 23.0 s. (a) Find his average speed during each quarter-mile segment. (b) Assuming that...

-

A velocitytime graph for an object moving along the x axis is shown in Figure P2.14. ] (a) Plot a graph of the acceleration versus time. (b) Determine the average acceleration of the object in the...

-

Why is a credit rating like a reputation? How could a credit rating help or hinder an individual?

-

A conservative investor has a well-diversified portfolio but is still concerned about two things. First, he is concerned about the downside risk and secondly, he is concerned whether he is earning a...

-

The BRL-INR exchange rate is BRL 1.45/INR. How many BRLs will 2,000 INR get you?

Study smarter with the SolutionInn App