Conduct a delta hedge similar to that in Section 5.4.3. In one case assume the stock price

Question:

Conduct a delta hedge similar to that in Section 5.4.3. In one case assume the stock price increases modestly over the 42 days until expiration. In another, generate a GRW 42 day price sequence.

Data given in Section 5.4.3

Data given in Figure 5.8

Transcribed Image Text:

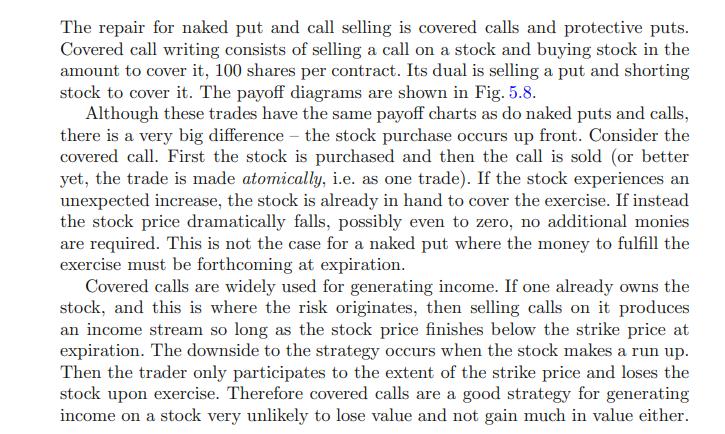

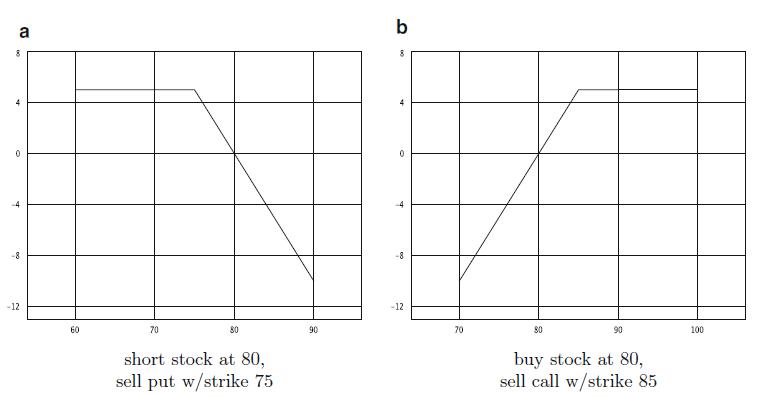

The repair for naked put and call selling is covered calls and protective puts. Covered call writing consists of selling a call on a stock and buying stock in the amount to cover it, 100 shares per contract. Its dual is selling a put and shorting stock to cover it. The payoff diagrams are shown in Fig. 5.8. Although these trades have the same payoff charts as do naked puts and calls, there is a very big difference - the stock purchase occurs up front. Consider the covered call. First the stock is purchased and then the call is sold (or better yet, the trade is made atomically, i.e. as one trade). If the stock experiences an unexpected increase, the stock is already in hand to cover the exercise. If instead the stock price dramatically falls, possibly even to zero, no additional monies are required. This is not the case for a naked put where the money to fulfill the exercise must be forthcoming at expiration. Covered calls are widely used for generating income. If one already owns the stock, and this is where the risk originates, then selling calls on it produces an income stream so long as the stock price finishes below the strike price at expiration. The downside to the strategy occurs when the stock makes a run up. Then the trader only participates to the extent of the strike price and loses the stock upon exercise. Therefore covered calls are a good strategy for generating income on a stock very unlikely to lose value and not gain much in value either.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Answered By

OTIENO OBADO

I have a vast experience in teaching, mentoring and tutoring. I handle student concerns diligently and my academic background is undeniably aesthetic

4.30+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

1. For each of the following sequences defined as a recurrence relations, List the first five terms of the sequence. Find a formula for the general term an in terms of n. 2, an+1 = an + 2n for n 1 a....

-

1. Morris Printers purchased for $900,000 a patent for a new laser printer. Although the patent gives legal protection for 20 years, it is expected to provide Morris Printers with a competitive...

-

Refrigerant-134a enters the coils of the evaporator of a refrigeration system as a saturated liquid-vapor mixture at a pressure of 140 kPa. The refrigerant absorbs 180 kJ of heat from the cooled...

-

Recall that the randomization test for the data in Example 3.5 fails to find evidence of a significant increase in the amount of wear with material B. Does this mean that material B has equivalent...

-

On January 2, 2010, the Whistler Company purchased land for $450,000, from which it is estimated that 400,000 tons of ore could be extracted. It estimates that it will cost $80,000 to restore the...

-

Mass Load Deflection Area Shear stress Strain Shear modulus Kg N m m^2 t(Pa) rads Pa 0.1 0.981 0.00002 0.0005376 1824.777 0.0004 4561941.964 0.204 2.001 0.00005 0.0005376 3722.545 0.001 3722544.643...

-

At the present time BAC is selling for 9.52. Its 18 day 10 dollar calls have these Greeks: = 0.3366, = 0.3509, = 0.0077 (directly from a brokers web site). (a) What are the corresponding Greeks of...

-

In addition to the Greeks as in Problem 1, for the 46 day 7.50 puts delta is 0.0528, gamma is 0.0738, and vega is 0.0036. Can you set up a delta-gamma-vega neutral position? Do so if possible. Data...

-

Discuss the concept of the limiting factor and indicate its importance in enhancing or constraining plant growth.

-

Give two reasons why Treasury rates are less than other very low risk rates in the United States.

-

What is the formula for the forward price of an investment asset that provides no income?

-

Under what circumstances is the futures price greater than the expected future spot price according to (a) Keynes and Hicks and (b) systematic risk considerations?

-

What is the formula for a forward exchange rate in terms of the spot exchange rate?

-

Explain the two ways derivatives trade in the OTC market?

-

When a parent company that records its investment using the cost method during a fiscal year sells a portion of its investment, explain the correct accounting for any differences between selling...

-

Multiple Choice Questions: 1. The largest component of aggregate demand is? a. Government purchases. b. Net exports. c. Consumption. d. Investment. 2. A reduction in personal income taxes, other...

-

An electron in a cathode ray tube (CRT) accelerates from 2.00 x 104 m/s to 6.00 x 106 m/s over 1.50 cm. (a) How long does the electron take to travel this 1.50 cm? (b) What is its acceleration?

-

In a 100-m linear accelerator, an electron is accelerated to 1.00% of the speed of light in 40.0m before it coasts for 60.0m to a target. (a) What is the electrons acceleration during the first 40.0...

-

Within a complex machine such as a robotic assembly line, suppose that one particular part glides along a straight track. A control system measures the average velocity of the part during each...

-

Why should you try to minimize spending and maximize saving? Explain at least one paragraph.

-

As the leader of your business performing managerial functions in your company, how will you hire employees? Explain some things you might like to know about employees who are prohibited by law from...

-

1) Calculate a forward Exchange rate 2)Calculate the CDN $ proceeds Export Euros 6,000,000 Canada Interest rate 3% per annum (365 day year) France Interest Rate 2% per annum Spot Rate 1.35000...

Study smarter with the SolutionInn App