At the beginning of 20X2, Devin Company changed its method of accounting for certain operating expenses. The

Question:

At the beginning of 20X2, Devin Company changed its method of accounting for certain operating expenses.

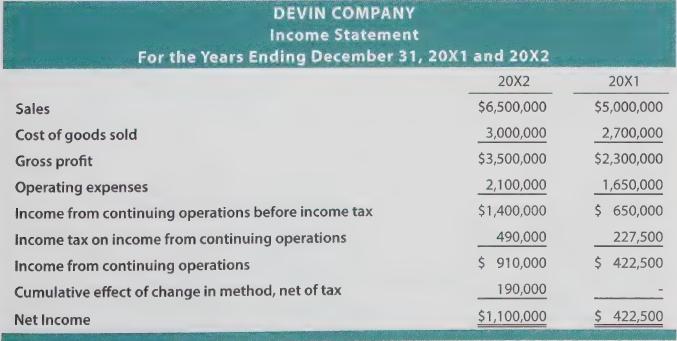

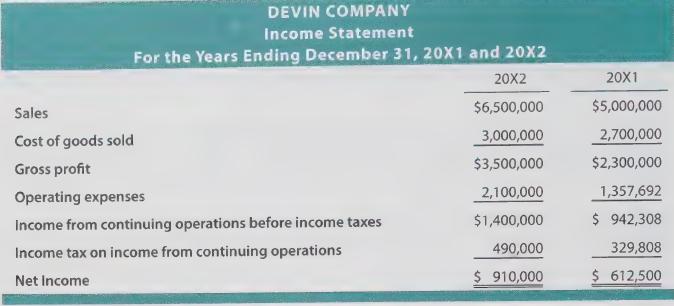

The change in methods shifted from one acceptable method to another acceptable method. Devin Company's accounting department was not sure how to report the effect of the change, and has prepared the following alternative comparative income statements.

The first option includes a cumulative effect catch-up adjustment for the change.

The second option results in changing the amount of operating expenses previously reported for 20X1. The company faces a 35% tax rate.

Which of the two income statements should be used? What was the dollar impact of the change in method, before and after tax. Did the change impact any years prior to 20X1?

Step by Step Answer: