Centenary Ceramics deals in ceramic pots and figurines. All sales are conducted on a credit basis and

Question:

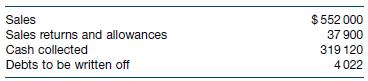

Centenary Ceramics deals in ceramic pots and figurines. All sales are conducted on a credit basis and no cash discounts are given. Ignore GST. The following information was extracted from the accounting records at 30 June 2019.

Required

(a) Assume that Centenary Ceramics uses the direct write‐off method of accounting for bad debts.

i. Show the general journal entry required to write off the bad debts.

ii. What amount would be shown for bad debts expense in the income statement at 30 June 2019?

iii. What amount would be shown for accounts receivable in the balance sheet at 30 June 2019?

(b) Assume that Centenary Ceramics uses the allowance method of accounting for bad debts and the Allowance for Doubtful Debts account had a credit balance of $2645 at 1 July 2018. Also assume that an allowance of 1% of net credit sales is required at 30 June 2019 (ignore GST).

i. Show the general journal entries required to write off the bad debts and bring in the required allowance for doubtful debts.

ii. What amount would be shown for bad debts expense in the income statement at 30 June 2019?

iii. What amount would be shown for accounts receivable in the balance sheet at 30 June 2019?

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield