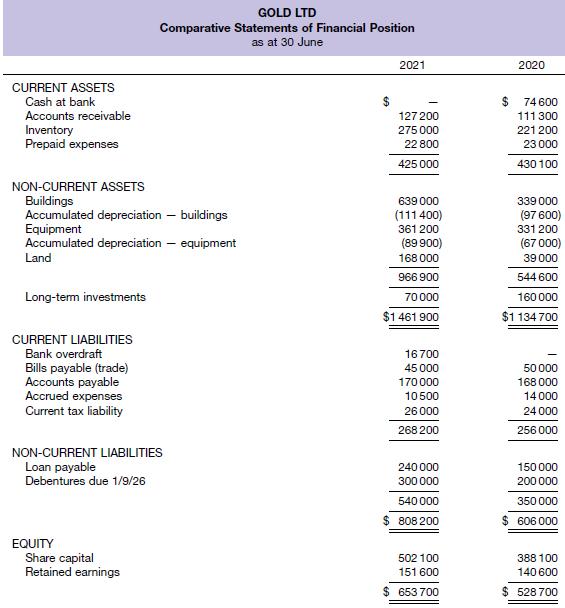

Comparative statements of financial position for Gold Ltd on 30 June 2020 and 2021 are presented overleaf.

Question:

Comparative statements of financial position for Gold Ltd on 30 June 2020 and 2021 are presented overleaf.

Examination of the company’s statement of profit or loss and other comprehensive income and general ledger accounts disclosed the following.

1. Profit (after tax) for the year ending 30 June 2021 was $80 000.

2. Depreciation expense was recorded during the year on buildings, $13 800, and on equipment, $22 900.

3. An extension was added to the building at a cost of $300 000 cash.

4. Long‐term investments with a cost of $90 000 were sold for $125 000.

5. Vacant land next to the company’s factory was purchased for $129 000 with payment consisting of $39 000 cash and a loan payable for $90 000 due on 30 June 2024.

6. Debentures of $100 000 were issued for cash at nominal value.

7. 30 000 shares were issued at $3.80 per share.

8. Equipment was purchased for cash.

9. Net sales for the period were $875 600; cost of sales amounted to $525 300; other expenses (other than depreciation, carrying amount of investments sold, interest, and bad debts written off, $3500) amounted to $149 400.

10. Income tax paid during the year amounted to $73 700, and interest paid on liabilities amounted to $40 000.

Required

(a) Prepare a statement of cash flows for the year ended 30 June 2021 using the direct method, and assuming that bank overdraft is part of the entity’s cash management activities.

(b) Prepare any notes required to be attached to the statement.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield