Francine Steele and Shaun Dunn formed a partnership on 1 July 2019. Some of Steeles business assets

Question:

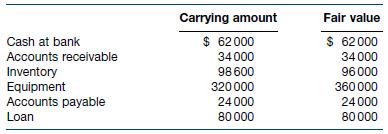

Francine Steele and Shaun Dunn formed a partnership on 1 July 2019. Some of Steele’s business assets and liabilities were assumed by the partnership, and these are listed below at both carrying amounts and fair value.

Dunn contributed a commercial property to the partnership that had a fair value of $670 000 which was financed by a mortgage of $220 000. They agreed to share profits and losses evenly.

During the first year of the partnership, Steele invested $80 000 in the business and withdrew $20 000. Dunn invested $82 000 and withdrew $24 000. The partnership had a profit of $132 800. Retained Earnings accounts are not used.

Required

(a) Prepare the general journal entries to record the initial investments of both partners (assume no GST).

(b) Prepare a balance sheet as at 1 July 2019.

(c) Prepare a statement of changes in partners’ equity for the year ended 30 June 2020.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield