Masons Manufacturing Ltd began operations during 2019. The company had a building constructed and acquired manufacturing equipment

Question:

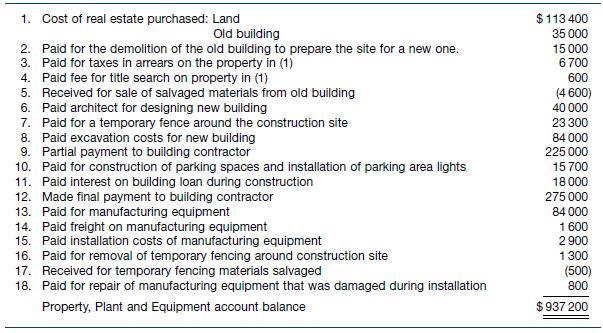

Mason’s Manufacturing Ltd began operations during 2019. The company had a building constructed and acquired manufacturing equipment during the first 6 months of the year. Manufacturing operations began early in July 2019. The company’s accountant, who was unsure how to treat property, plant and equipment transactions, opened a Property, Plant and Equipment account and debited (credited) that account for all the expenditures and receipts involving assets as shown below (ignore GST).

Required

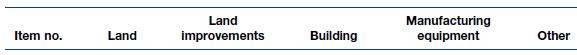

(a) Prepare a schedule similar to the one below. Analyse each transaction and enter the payment (receipt) in the appropriate column. Total the columns.

(b) Prepare a general journal entry to close the $937 200 balance in the Property, Plant and Equipment account and allocate the amounts to their appropriate accounts.

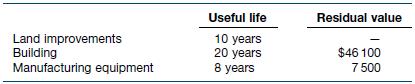

(c) Prepare an entry to record depreciation expense for half the year to 31 December 2019 on land improvements, building and manufacturing equipment using straight‐line depreciation.

Useful lives and residual values are as follows.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield