Rocks Shoes is a three-year old company that started out producing specialty shoes for rock climbing and

Question:

Rocks Shoes is a three-year old company that started out producing specialty shoes for rock climbing and mountaineering. However, their unique styling has made them a hit with the general public and they are now growing rapidly. Rocks needs additional capital to expand their manufacturing capacity, and they plan to sell additional shares of stock to raise money.

During its first three years in operation, Rocks used the direct-write off method to account for uncollectible accounts.

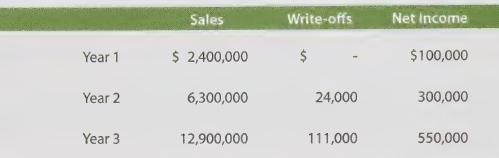

Information about sales, write-offs, and the company's income follows:

Rocks is required to have audited financial statements, prior to offering its shares of stock for sale. This will require the company to recompute its income under generally accepted accounting principles for each of the three prior years. The only item that requires adjustment is the treatment of uncollectible accounts.

Rocks estimates that 3% of sales ultimately prove to be uncollectible -- 1% in the year following a sale, and 2% in the year thereafter.

(a) Prepare the journal entries that were used by Rocks for each year under the direct write-off method.

(b) Determine if the actual write-offs are aligning with the estimates provided by Rocks. Why does GAAP require an allowance method for uncollectibles?

(c) Prepare the journal entries that would have been made each year, had the percentage of sales technique been used to establish an allowance account. Be sure to include entries to both establish the allowance, and to record the write offs.

(d) How much is the corrected net income for each year? Will the reduction in income potentially impact the amount of capital that can be raised?

Step by Step Answer: