Selected transactions of Coromandel Ltd are given below. The company uses straightline depreciation and calculates depreciation expense

Question:

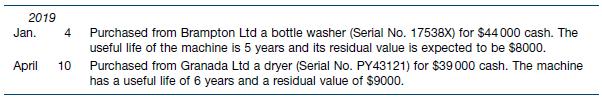

Selected transactions of Coromandel Ltd are given below. The company uses straight‐line depreciation and calculates depreciation expense to the nearest whole month. Ignore GST.

Required

(a) Prepare journal entries to record the purchase of the assets and to record depreciation expense on 30 June 2019 and 2020, the end of the company’s reporting periods.

(b) Open a Machinery account (No. 230) and an Accumulated Depreciation — Machinery account (No. 231), and prepare subsidiary property and plant records for the two assets. Post the journal entries to the general ledger accounts and to the subsidiary property and plant records.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield