This problem requires you to team with one other person. One of you will assume the role

Question:

This problem requires you to team with one other person. One of you will assume the role of accountant for Company A (based in Miami), and the other for Company B (based in London). You should each prepare your company's journal entries for the following purchase and sale transactions. On the sale transactions, you may disregard recording of any cost of goods sold. Compare your results and consider why Company A's foreign currency transaction gain or loss is not offset on Company B's books (and vice versa).

Sale of inventory by Company A to Company B:

This transaction was for $5,000, on account. The date of sale was March 1, and settlement occurred on April 1.

Sale of inventory by Company A to Company B:

This transaction was for £2,500, on account. The date of sale was April 1, and settlement occurred on May 1.

Purchase of inventory by Company A from Company B:

This transaction was for $7,000, on account. The date of purchase was May 1, and settlement occurred on June 1.

Purchase of inventory by Company A from Company B:

This transaction was for £3,500, on account. The date of purchase was June 1, and settlement occurred on July 1.

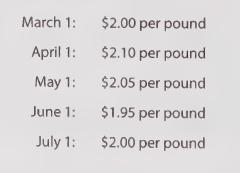

The exchange rate of dollars ($) for pounds (£) fluctuated as follows:

Step by Step Answer: