American Airlines Group, Inc., provides the following disclosures in the notes to their 2018 financial statements (excerpted

Question:

American Airlines Group, Inc., provides the following disclosures in the notes to their 2018 financial statements (excerpted for brevity):

ASU 2016-02: Leases (Topic 842) (the New Lease Standard):

The New Lease Standard requires lessees to recognize a lease liability and a right-of-use (ROU) asset on the balance sheet for operating leases. Accounting for finance leases is substantially unchanged. The New Lease Standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. Early adoption is permitted.

In the fourth quarter of 2018, we elected to early adopt the New Lease Standard as of January 1, 2018 using a modified retrospective transition, with the cumulative-effect adjustment to the opening balance of retained earnings as of the effective date (the effective date method). Under the effective date method, financial results reported in periods prior to 2018 are unchanged .

The adoption of the New Lease Standard had a significant impact on our consolidated balance sheet due to the recognition of approximately $10 billion of lease liabilities with corresponding right-of-use assets for operating leases.

6.Leases:

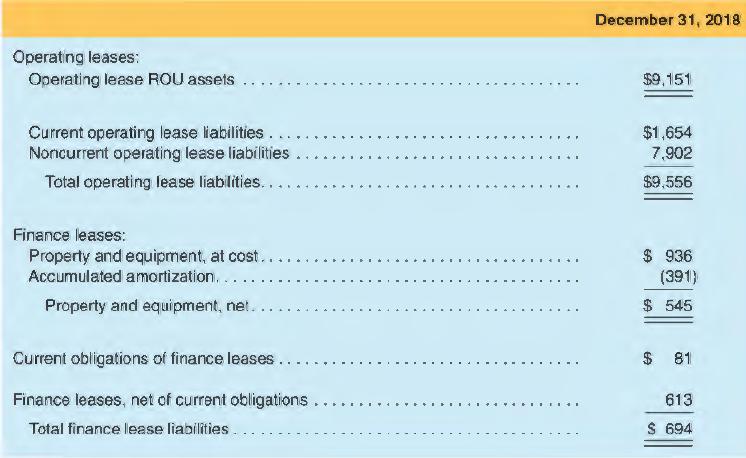

We lease certain aircraft and engines, including aircraft under capacity purchase agreements. As of December 31, 2018, we had 660 leased aircraft, with remaining terms ranging from less than one year to 12 years. Supplemental balance sheet information related to leases was as follows (in millions, except lease term and discount rate):

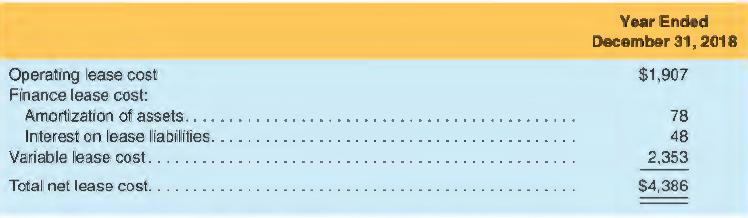

The components of lease expense were as follows (in millions):

a. What is the right-of-use asset for operating leases as of the end of 2018?

b. What is the net asset recorded for finance leases?

c. What is the lease liability balance for operating leases as of the end of 2018? What does this amount represent?

d. What is the amount of amortization expense recorded in 2018 for finance leases? For operating leases?

e. What is the amount of interest expense recorded in 2018 for finance leases? For operating leases?

f. Using the $10 billion round figure that American cites, show the journal entry that American would have recorded to account for operating leases under the new standard on the date of adoption.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman