Apple Inc. provides the following dis closure in the notes to its 2018 financial statements: Other Off-Balance-Sheet

Question:

Apple Inc. provides the following dis closure in the notes to its 2018 financial statements:

Other Off-Balance-Sheet Commitments Unconditional Purchase Obligations:

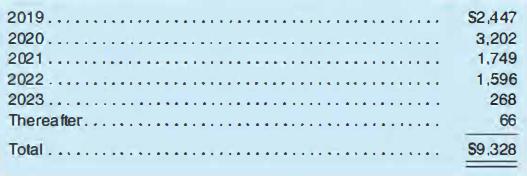

The Company has entered into certain off-balance-sheet arrangements which require the future purchase of goods or services ("unconditional purchase obligations").The Company's unconditional purchase obligations primarily consist of payments for supplier arrangements, internet and telecommunication services and intellectual property licenses. Future payments under noncancelable unconditional purchase obligations having a remaining term in excess of one year as of September 29, 2018, are as follows (in millions ):

Contingencies:

The Company is subject to various legal proceedings and claims that have arisen in the ordinary course of business and that have not been fully adjudicated. The outcome of litigation is inherently uncertain. If one or more legal matters were resolved against the Company in a reporting period for amounts in excess of management's expectations, the Company's financial condition and operating results for that reporting period could be materially adversely affected. In the opinion of management, there was not at least a reasonable possibility the Company may have incurred a material loss, or a material loss in excess of a recorded accrual, with respect to loss contingencies tor asserted legal and other claims, except for the following matters:

Qualcomm:

On January 20, 2017, the Company filed a lawsuit against Qualcomm Incorporated and affiliated parties ("Qualcomm") in the U.S. District Court for the Southern District of California seeking, among other things, to enjoin Qualcomm from requiring the Company to pay royalties at the rate demanded by Qualcomm. As the Company does not believe the demanded royalty it has historically paid contract manufacturers for each applicable device is fair, reasonable and non-discriminatory, and believes it to be invalid and/or overstated in other respects as well, no Qualcomm-related royalty payments have been remitted by the Company to its contract manufacturers since the beginning of the second quarter of 2017. The Company believes it will prevail on the merits of the case and has accrued its best estimate for the ultimate resolution of this matter.

a. Apple discloses that its rate of interest on 5-year debt securities is roughly 2.5%. Compute the present value of the future payments related to their off-balance-sheet purchase obligation.

b. What would an analyst consider this to be-an asset, a liability, or equity?

c. Has Apple recorded a liability with respect to the litigation and contract with Qualcomm? What amount is recorded, if any?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman