Caterpillar Inc. and Komatsu Ltd. are international manufacturers of industrial and construction equipment. Caterpillar's headquarters is in

Question:

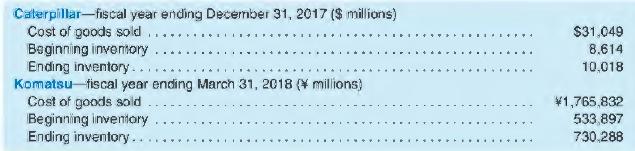

Caterpillar Inc. and Komatsu Ltd. are international manufacturers of industrial and construction equipment. Caterpillar's headquarters is in the United States, while Komatsu's headquarters is in Japan. The following information comes from their recent financial statements.

In its footnotes, Caterpillar also provides the following information (assume no LIFO liquidation):

Inventories:

Inventories are stated at the lower of cost or market. Cost is principally determined using the last-in, first-out (LIFO) method. The value of inventories on the LIFO basis represented about 65 percent of total inventories at December 31, 2017, and about 60 percent at December 31, 2016. If the FIFO (first-in, first-out) method had been in use, inventories would have been $1,934 million and $2,139 million higher than reported at December 31, 2017 and 2016, respectively.

REQUIRED:

a. Calculate the inventory turnover and average inventory days outstanding ratios for Caterpillar and Komatsu using the information reported in their financial statements. Describe some operational reasons that companies might have differing inventory ratios, even if they are in the same industry.

b. Did the cost of Caterpillar's acquiring (i.e., producing) products go up or down in 2017?

c. Assuming a 25% income tax rate, by what cumulative dollar amount has Caterpillar's tax liability been affected by use of LIFO inventory costing as of fiscal year-end 2017 Has the use of LIFO inventory costing increased or decreased its cumulative tax liability?

d. What effect has the use of LIFO inventory costing had on Caterpillar's pretax income and tax liability for fiscal year 2017? (Assume a 25% tax rate.)

e. In its footnotes, Komatsu reports that it "determines cost of work in process and finished products using the specific identification method based on actual costs accumulated under a job-order cost system. The cost of finished parts is determined principally using the first-in, first-out method." What effect does this footnote have on your interpretation in question a above? Use the information available to make a more appropriate comparison of the two companies' inventory turnover.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman