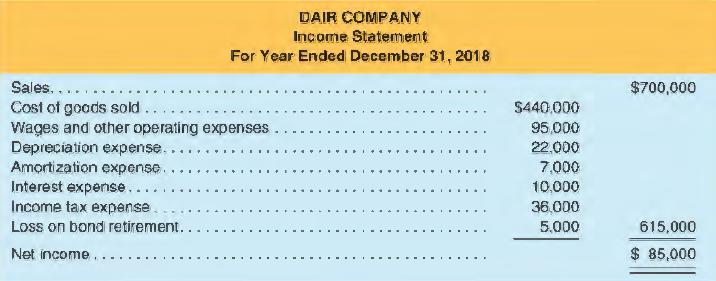

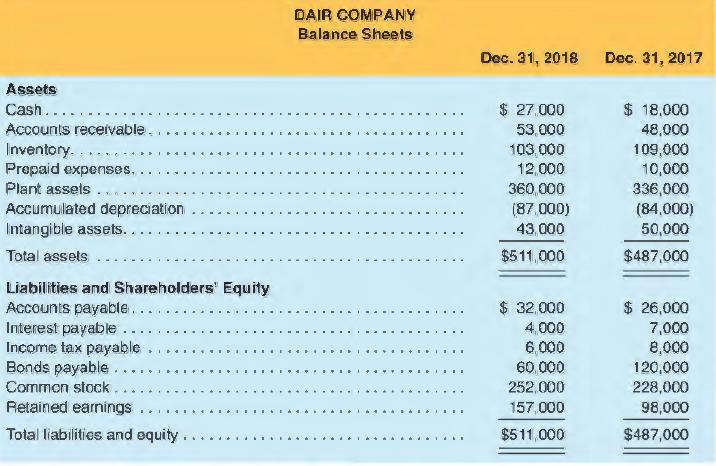

Dair Company's income statement and comparative balance sheets follow. During 2018, the company sold for $17,000 cash

Question:

Dair Company's income statement and comparative balance sheets follow.

During 2018, the company sold for $17,000 cash old equipment that had cost $36,000 and had $19,000 accumulated depreciation. Also in 2018, new equipment worth $60,000 was acquired in exchange for $60,000 of bonds payable, and bonds payable of $120,000 were retired for cash at a loss. A $26,000 cash dividend was declared and paid in 2018. Any stock issuances were for cash.

REQUIRED:

a. Compute the change in cash that occurred in 2018.

b. Prepare a 2018 statement of cash flows using the indirect method.

c. Prepare separate schedules showing.

(1) Cash paid for interest and for income taxes.

(2) Noncash investing and financing transactions.

d. Compute its

(1) operating cash flow to current liabilities ratio,

(2) operating cash flow to capital expenditures ratio, and

(3) free cash flow.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman