DowDuPont Inc. provides the following footnote disclosures in its 10-K report relating to its pension plans. REQUIRED:

Question:

DowDuPont Inc. provides the following footnote disclosures in its 10-K report relating to its pension plans.

REQUIRED:

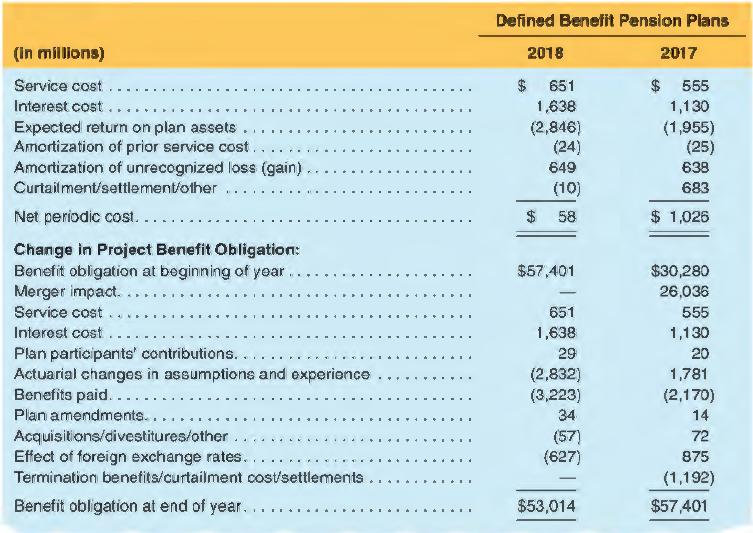

a. How much pension expense (revenue) does Dow DuPont report in its 2018 income statement?

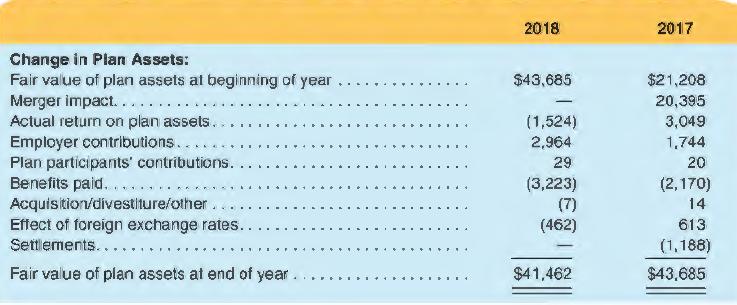

b. Dow DuPont reports a $2,846 million expected return on plan assets as an offset to 2018 pension expense. Estimate the rate of return DowDuPont expected to earn on its plan assets in 2018.

c. What factors affected its 2018 pension liability? What factors affected its 2018 plan assets?

d. What does the term funded status mean? What is the funded status of the 2018 Dow DuPont retirement plans at the end of 2018? What amount of asset or liability should DowDuPont report on its 2018 balance sheet relating to its retirement plans?

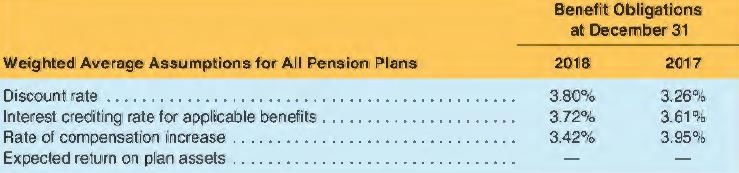

e. Dow DuPont changed its discount rate from 3.26% to 3.80% in 2018. What effect(s) does this change have on its balance sheet and its income statement?

f. Suppose Dow DuPont increased its estimate of expected returns on plan assets in 2019. What effect(s) would this increase have on its income statement? Explain.

g. DowDuPont provides us with its weighted-average discount rate. The company operates 441 manufacturing facilities and has roughly 98,000 employees all over the world. Would you expect that the discount rate differed in the United States from the average rate outside the United States? Explain. What would you expect for future compensation levels?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman