Following is a portion of the investments footnote 8 from MetLife lnc.'s 2017 10-K report. Investment earnings

Question:

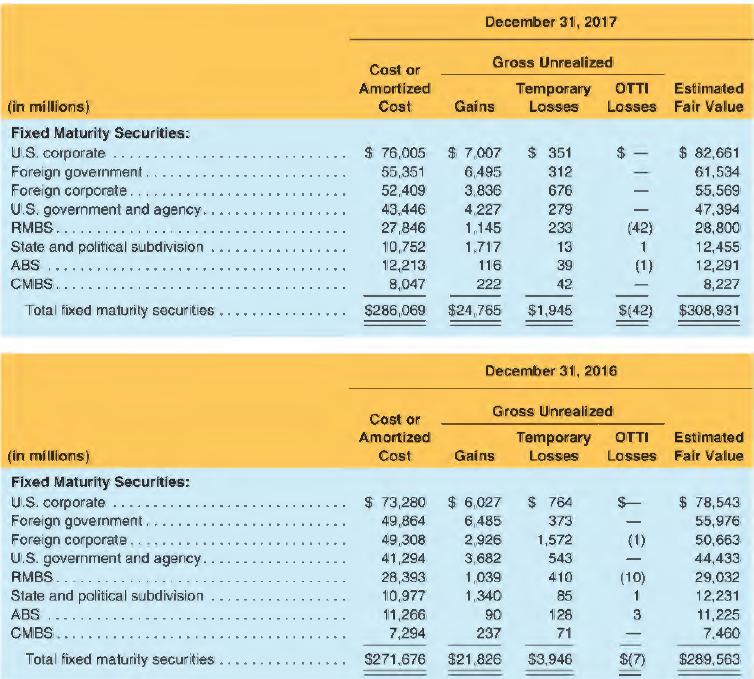

Following is a portion of the investments footnote 8 from MetLife lnc.'s 2017 10-K report. Investment earnings are a crucial component of the financial performance of insurance companies such as MetLife, and investments comprise a large part of its assets. MetLife accounts for its bond investments as available-for-sale securities. Fixed Maturity Securities Available-for-Sale The following tables present the fixed maturity securities AFS by sector.

REQUIRED:

a. At what amount does MetLife report its bond investments on its balance sheets for 2017 and 2016?

b. What are its net unrealized gains (losses) for 2017 and 2016? By what amount did these unrealized gains (losses) affect its reported income?

c. What is the difference between realized and unrealized gains and losses? Are realized gains and losses treated differently in the income statement than unrealized gains and losses? MetLife's 2017 pre-tax income was $3,536 million. What is the maximum amount MetLife could have increased pre-tax income by selling available-for-sale securities on the last day of 2017?

d. Many analysts compute a mark-to-market investment return as follows: Net investment income + Realized gains and losses + Change in unrealized gains and losses. Do you think that this metric provides insights into the performance of MetLife's investment portfolio beyond that which is included in GAAP income statements? Explain.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman