Hamish's Slot Cars Pty Limited is an importer of high-quality racing tracks and slot cars. The following

Question:

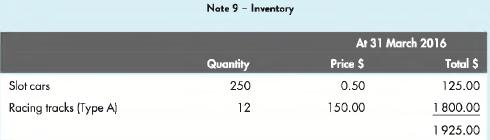

Hamish's Slot Cars Pty Limited is an importer of high-quality racing tracks and slot cars. The following are extracts from the company's financial statements for the year ended 31 March 2016.

Note 1 - Accounting policies Inventory

Inventories on hand and in transit are valued at the lower of cost and net realisable value. Cost is determined using periodic FIFO methodology for slot cars and perpetual moving weighted average for racing tracks.

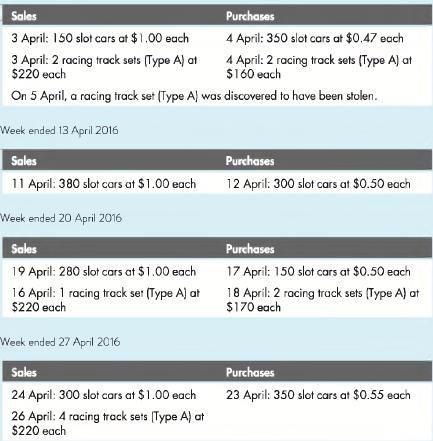

The following information relates to transactions during the month of April 2016: Week ended 6 April 2016

Additional information

A physical count of slot cars in the shop following close of business on 30 April 2016 indicated there were 290 slot cars and eight racing track sets (Type A) on hand.

1. Calculate COGS for April 2016 and closing inventory as at 30 April 2016 for slot cars and for racing track sets.

2. On average, prices of slot cars have increased over the last few months. If the company decided to change its inventory policy for slot cars from FIFO to LIFO, explain the likely direction of the impact on profit for the month of April 2016.

3. On 30 April 2016 a new type of racing track set (Type B) was released by the supplier and is likely to be very popular. The company estimates that to sell its inventory of type A racing track sets during May 2016 it will need to discount them to $132. What journal entry, if any, should be recorded in April 2016 in relation to this information?

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson