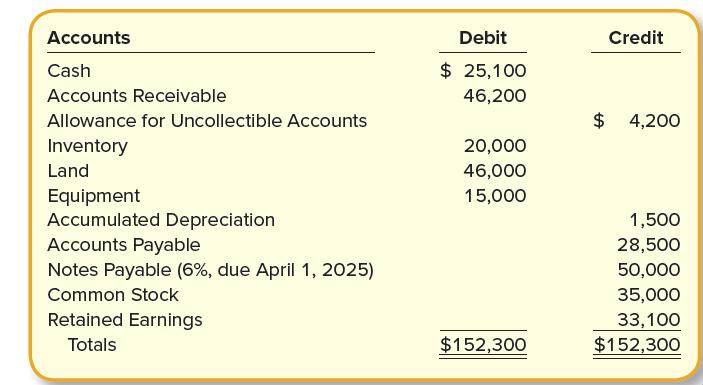

On January 1, 2024, the general ledger of ACME Fireworks includes the following account balances: During January

Question:

On January 1, 2024, the general ledger of ACME Fireworks includes the following account balances:

During January 2024, the following transactions occur:

January 2 Sold gift cards totaling $8,000. The cards are redeemable for merchandise within one year of the purchase date.

January 6 Purchase additional inventory on account, $147,000. ACME uses the perpetual inventory system.

January 15 Firework sales for the first half of the month total $135,000. All of these sales are on account. The cost of the units sold is $73,800.

January 23 Receive $125,400 from customers on accounts receivable.

January 25 Pay $90,000 to inventory suppliers on accounts payable.

January 28 Write off accounts receivable as uncollectible, $4,800.

January 30 Firework sales for the second half of the month total $143,000. Sales include $11,000 for cash and $132,000 on account. The cost of the units sold is $79,500.

January 31 Pay cash for monthly salaries, $52,000.

Required:

1. Record each of the transactions listed above.

2. Record adjusting entries on January 31.

a. Depreciation on the equipment for the month of January is calculated using the straightline method. At the time the equipment was purchased, the company estimated a residual value of $3,000 and a two-year service life.

b. The company records an adjusting entry for $12,500 for estimated future uncollectible accounts.

c. The company has accrued interest on notes payable for January.

d. The company has accrued income taxes at the end of January of $13,000.

e. By the end of January, $3,000 of the gift cards sold on January 2 have been redeemed (ignore cost of goods sold).

3. Prepare an adjusted trial balance as of January 31, 2024, after updating beginning balances (above) for transactions during January (requirement 1) and adjusting entries at the end of January (requirement 2).

4. Prepare a multiple-step income statement for the period ended January 31, 2024.

5. Prepare a classified balance sheet as of January 31, 2024.

6. Record closing entries.

7. Analyze the following for ACME Fireworks:

a. Calculate the current ratio at the end of January. If the average current ratio for the industry is 1.8, is ACME Fireworks more or less liquid than the industry average?

b. Calculate the acid-test ratio at the end of January. If the average acid-test ratio for the industry is 1.5, is ACME Fireworks more or less likely to have difficulty paying its currently maturing debts (compared to the industry average)?

c. Assume the notes payable were due on April 1, 2024, rather than April 1, 2025. Calculate the revised current ratio at the end of January, and indicate whether the revised ratio would increase, decrease, or remain unchanged compared to your answer in (a).

Step by Step Answer: