Restaurant Brands International, Inc. reports the following in footnote 13 to their financial statements in their 2017

Question:

Restaurant Brands International, Inc. reports the following in footnote 13 to their financial statements in their 2017 I 0-K related to redeemable preferred stock.

Note 13

Redeemable Preferred Shares

On December 12, 2014 we issued 68,530,939 Class A 9.0% cumulative compounding perpetual voting preferred shares (the "Preferred Shares") to a subsidiary of Berkshire Hathaway, which were outstanding until the Redemption Date (as defined below). A 9.0% annual dividend accrued on the purchase price of $43. 775848 per Preferred Share, and was payable quarterly in arrears, when declared and approved by our board of directors. The Preferred Shares were redeemable at our option on and after December 12, 2017. During 2014, we adjusted the carrying value of the Preferred Shares to their redemption price of $48.109657 per Preferred Share (the "redemption price"). The Preferred Shares were classified as temporary equity while outstanding because redemption was not solely within our control, as the Preferred Shares also contained provisions that allowed the holder to redeem the Preferred Shares for cash beginning in December 2024 or upon a change in control. On December 12, 2017 (the "Redemption Date"), we redeemed all of the issued and outstanding Preferred Shares for aggregate consideration of $3,115.6 million (the "Redemption Consideration"), consisting of (i) $3,297.0 million, which is the redemption price of $48.109657 per Preferred Share multiplied by the number of Preferred Shares outstanding, plus (ii) $54.0 million of accrued and unpaid preferred dividends up to the Redemption Date, minus (iii) an adjustment of $235.4 million, .. . The $235.4 million adjustment, net of $1.6 million of related transaction costs, is reflected as a $233.8 million increase to net income attributable to common shareholders and common shareholder's equity .... Upon redemption, the Preferred Shares were deemed canceled, dividends ceased to accrue and all rights of the holder terminated.

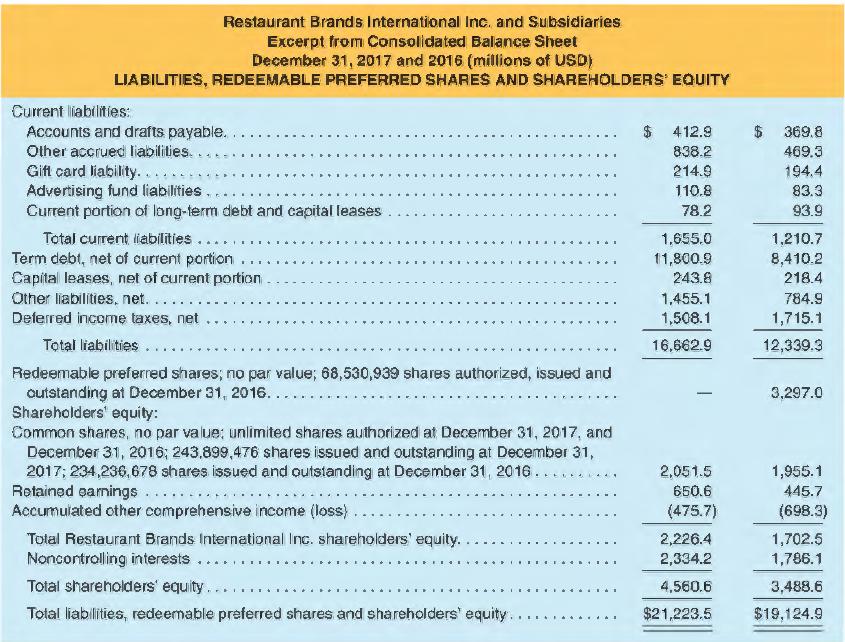

The company's balance sheet, in pa11, reflected the following:

a. Where were the redeemable preferred shares listed on the balance sheet before they were redeemed?

b. What was the aggregate sales price of the redeemable preferred shares in 2014?

c. When issued, $250 million of the issue price was allocated to warrants that were issued as part of the transaction in 2014. Later in 2014, the company adjusted the carrying value of the redeemable preferred shares to their redemption price of $3,297 million. What was the increase in the carrying value of the shares? Where would this have been reported, if at all?

d. If you were an analyst of the company, how would you have viewed these shares?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman