The Metropolitan Opera Association, Inc., was founded in 1883 and is widely regarded as one of the

Question:

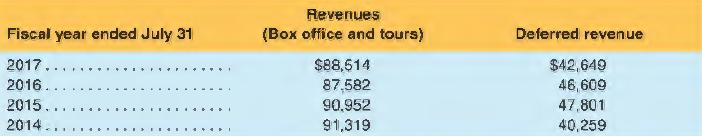

The Metropolitan Opera Association, Inc., was founded in 1883 and is widely regarded as one of the world's greatest opera companies. The Metropolitan's performances run from September to May, and the season may consist of more than two dozen different operas. Many of the opera's loyal subscribers purchase tickets for the upcoming season prior to the end of the opera's fiscal yearend at July 31. In its annual report, the Metropolitan recognizes a Deferred Revenue liability that is defined in their footnotes as follows. "Advance ticket sales, representing the receipt of payments for ticket sales for the next opera season, are reported as deferred revenue in the consolidated balance sheets." Ticket sales are recognized as box office revenue "on a specific performance basis."

a. What revenue recognition principle(s) drive The Metropolitan Opera's deferral of advance ticket purchases?

b. Recreate the summary journal entries to recognize ticket sales revenue (box office and tours) for The Metropolitan Opera's fiscal year2017 and advance sales for the fiscal year2018 season. (Assume that advance ticket sales extend no further than the next year's opera season.)

c. The Metropolitan Opera's season changes every year. At the end of each fiscal year, management of the opera can observe the revenue generated by the season just concluded and also its subscribers' enthusiasm for the upcoming season. How might that information be used in managing the organization?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman