The Sydney Cricket Ground Trust released the following offer: 1. Assume the Trust is the promoter of

Question:

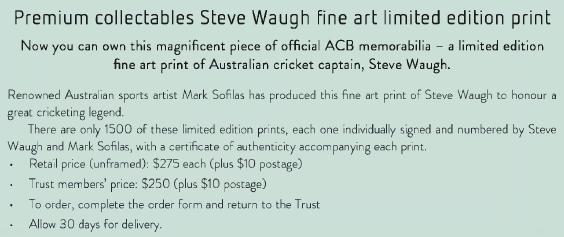

The Sydney Cricket Ground Trust released the following offer:

1. Assume the Trust is the promoter of the limited edition prints (i.e. it receives all revenues and pays all costs). Describe the alternatives the Trust has in relation to when it recognises revenue. Which would you suggest?

2. How would your answer differ if the Trust included an offer that the prints could be returned within two months if the purchaser is not completely satisfied? The purchaser would receive a refund of $200.

3. Assume the Trust is not the promoter but is a selling agent; that is, it sends out the brochures, collects the order forms, retains 20 percent ($55) per print and passes the order on to the promoter, which fills the order. Assume a no-refund policy. When should the Trust recognise revenue?

4. Does the accounting profession have the skills to provide the certificate of authenticity? Do you believe the Trust, or any other seller of collectables, is likely to see advantages in members of professional accounting bodies providing this certificate of authenticity?

5. A Trust member was sitting behind two accounting students at a recent match and heard them discussing cost of goods sold. He shows you the above brochure, buys you a beer each and asks you what the COGS would be for the limited edition print.

6. Assume Steve Waugh receives a flat fee for signing the prints. When would the Trust recognise this expense?

7. Assume Steve Waugh gets paid a commission based on sales. When would the Trust recognise this expense?

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson