Agnes paid 4,000 to buy a gas cooker from Linda and sold it for 5,000 plus VAT

Question:

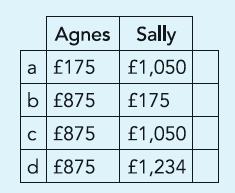

Agnes paid £4,000 to buy a gas cooker from Linda and sold it for £5,000 plus VAT to Sally who, in turn, sold it for a VAT inclusive price of £7,050 to Catherine, a customer. Agnes and Sally are VAT registered; while Linda is not. VAT rate is 17.5%. How much VAT would Agnes and Sally have to pay?

Transcribed Image Text:

Agnes Sally a £175 £1,050 b £875 £175 c £875 £1,050 d £875 £1,234

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

d ...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

On 1 March 2019 Salvador Doritos became a partner in Royal Foods, a partnership carrying on a catering business. Prior to becoming a partner Salvador had been employed as a catering manager by Royal...

-

Write an application that calculates the amount of money earned on an investment, based on an 8 percent annual return. Prompt the user to enter an investment amount and the number of years for the...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Seth borrows X for ten years at an annual effective interest rate of 4%, to be repaid with equal payments at the end of each year. The outstanding loan balance at the end of the eighth year is...

-

Rikki and Rhonda are equal owners of LilMark Corporation. To expand their operations, Marsha will contribute a building worth $80,000 for which she will receive a one third ownership interest in the...

-

Describe how the five forces can be used to determine the average expected profitability in an industry.

-

Between January and February 2023, the unemployment rate and the labor force participation rate both increased, while the employment population ratio remained unchanged and employment increased by...

-

1. Economic profit equals ________minus________. 2. Economic cost equals ________cost plus ________cost. 3. For a perfectly competitive firm, marginal revenue equals ________, and to maximize profit,...

-

QUESTION TWO a) State and explain five monetary policy instruments used by the central bank to regulate interest rate, inflation rate, exchange rate and the quantity of money in the economy [15...

-

If a VAT-registered trader formats his Sales Day Book to record VAT amounts in a separate column, the total of that column should be periodically posted to: (a) Debit of VAT account (b) Credit of VAT...

-

The Sales Day Book formatted with a separate column to record VAT reports 485,000 in the column that is posted to the Sales account and VAT rate is 17.5%. How and at what amount will the related VAT...

-

In Problems 1724, find the indicated derivative for each function. y" for y=(x16)5

-

What percent of the total population is found between the mean and the z-score given in Problems 11-22? \(z=-0.46 \)

-

Use the nutritional information about candy bars given in Table 14.7 to answer the questions in Problems 45 and 46. Table 14. 7 a. Find the three quartiles for serving size. b. Draw a box plot for...

-

The mean defined in the text is sometimes called the arithmetic mean to distinguish it from other possible means. For example, a different mean, called the harmonic mean (H.M.), is used to find...

-

In Problems 25-40, decide on a reasonable means for conducting the survey to obtain the desired information. Suppose the city wants to sample people from a long street that starts in the poor area...

-

How would the practice of minimum compliance differ with a public company compared to a private company?

-

On January 1, 2017, Black Jack Corporation purchases all of the preferred stock and 60% of the common stock of Zeppo Company for $56,000 and $111,000, respectively. Immediately prior to the...

-

If the joint cost function for two products is C(x, y) = xy2 + 1 dollars (a) Find the marginal cost (function) with respect to x. (b) Find the marginal cost with respect to y.

-

For the following independent situations, determine the optimum filing status for the years in question. a. Wayne and Celia had been married for 24 years before Wayne died in an accident in 2014....

-

Jim and Pat are married and file jointly. In 2016, Jim earned a salary of $46,000. Pat is self-employed. Her gross business income was $49,000 and her business expenses totaled $24,000. Each...

-

In 2016, Lana, a single taxpayer with AGI of $85,400, claims exemptions for three dependent children, all under age 17. What is the amount of her child credit?

-

Write an equation of the line that passes through (5,-2) and is perpendicular to the line defined by x-3y=1. Write the answer in slope-Intercept form (If possible) and in standard form (Ax+By C) with...

-

On the statement of cash flows, if inventory decreases: Select one: a. it is a source of cash, since the firm is selling inventory b. it is a source of cash, since the firm is buying inventory that...

-

A system of linear equations with no solutions. X 2 22 22 (b) A matrix A such that A = AT. A: AT = [33] 4 (c) Two matrices A and B so that A+ B is not defined. (d) Two matrices A and B so that AB and...

Study smarter with the SolutionInn App