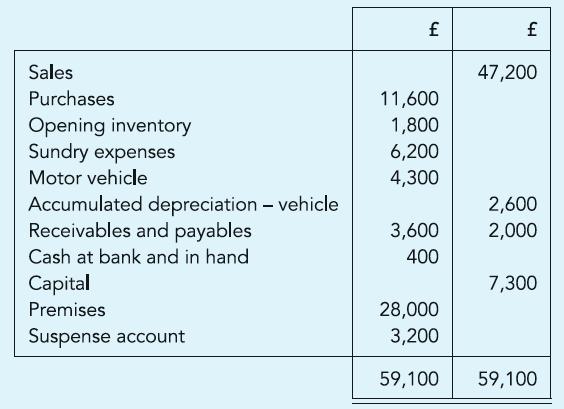

Patrice has produced the following draft Trial Balance as at 31 March 2012.Subsequent investigation reveals the following

Question:

Patrice has produced the following draft Trial Balance as at 31 March 2012.Subsequent investigation reveals the following points:

(i) An office computer was purchased for £1,500 during the year and was debited to the Purchase account rather than than an Office equipment account. No depreciation is to be charged on the computer in its first year in the business.

(ii) An invoice for goods received from a supplier Katy Ltd for £800 has been mislaid and no entry has been made.

(iii) A payment of £220 for sundry expenses has been entered correctly in the Cash Book but posted as £20.

(iv) The total of the Purchases Returns Journal of £1,000 has not been posted to the General ledger. Correct entries have been made in the individual accounts in the Sales ledger.

(v) £500 received from a customer, correctly entered in the Cash Book, has not been posted.

(vi) The total of the Sales Returns Journal of £3,200 is not posted to the General ledger, though correct entries have been made in the individual accounts in the Sales ledger.

(vii) £1,300 paid to a supplier and correctly entered in the Cash Book has not been posted.

(viii) The cost of inventory as at 31 March 2012 has been ascertained at £2,400.

(ix) Depreciate equipment by £300 and Motor vehicles by £400. Ignore depreciation of premises.

Required:

(a) Journal entries to correct the errors.

(b) Show the Suspense account.

(c) Statement of income for the year ended 31 March 2012.

(d) the Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict