Rice Automotive ended December 2009 with Accounts Receivable of $30,000 and Allowance for Uncollectible Accounts of $1,500.

Question:

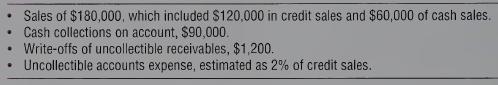

Rice Automotive ended December 2009 with Accounts Receivable of $30,000 and Allowance for Uncollectible Accounts of $1,500. During January 2010, Rice Automotive completed the following transactions:

Requirements 1. Prepare journal entries to record sales, collections, write offs of uncollectibles, and uncollectible accounts expense by the percent-of-sales method.

2. Calculate the ending balances in Accounts Receivable, Allowance for Uncollectible Accounts, and net Accounts Receivable at January 31. Flow much does Rice Automotive expect to collect?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: