Rio Tinto is a leading global mining group that focuses on finding, mining and processing the Earths

Question:

Rio Tinto is a leading global mining group that focuses on finding, mining and processing the Earth’s mineral resources. Our vision is to be a company that is admired and respected for delivering superior value, as the industry’s most trusted partner.

Critical accounting policies and estimates: (v) Close-down, restoration and environmental obligations Provision is made for close-down, restoration and environmental costs when the obligation occurs, based on the net present value of estimated future costs with, where appropriate, probability weighting of the different remediation, closure or other activities required to achieve relinquishment. The ultimate cost of close-down and restoration is uncertain and management uses its judgment and experience to provide for these costs over the life of the operations. Cost estimates can vary in response to many factors including: changes to the relevant legal or localational government ownership requirements or the Group’s closure and environmental policies; review of remediation and relinquishment options; the emergence of new restoration techniques; the timing of the expenditures and the effects of inflation.

Experience gained at other mine or production sites is also a significant consideration.

Cost estimates are updated throughout the life of the operation. The accuracy range for operations with a remaining life of ten to 40 years is +/−30 per cent. For operations with a remaining life of five to ten years, the accuracy range is +/−20 per cent. Five years prior to the estimated date of closure, operations must produce a full decommissioning plan with an accuracy range of +/−15 per cent.

The expected timing of expenditure included in cost estimates can also change, for example in response to changes to expectations relating to ore reserves and resources, production rates, operating licence or economic conditions. Expenditure may occur before and after closure and can continue for an extended period of time depending on the specific site requirements. Some expenditure can continue into perpetuity.

Cash flows must be discounted if this has a material effect. The selection of appropriate sources on which to base the calculation of the risk-free discount rate used for such obligations also requires judgment.

As a result of all of the above factors, there could be significant adjustments to the provision for close-down, restoration and environmental costs which would affect future financial results. Increases and decreases in environmental obligations are charged directly to the income statement. Increases and decreases in close-down obligations are capitalised for operating businesses. An increase in close-down and restoration provisions would increase the unwind of the discount and depreciation charges in the income statement in future years and increase the carrying value of property, plant and equipment potentially impacting any future impairment charges or reversals.

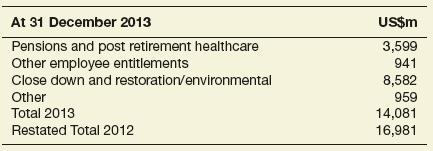

Notes to the financial statements 26 Provisions (including post retirement benefits) (extract)

(Figures in US$m)

Discussion points 1 Why is there a provision for close down and restoration when those events may take place many years into the future?

2 What are the significant uncertainties in estimating the amount of the provision?

Step by Step Answer: