Salvage Society was registered as a charity on 1 January 2011 when some retired persons in Wimbledon

Question:

Salvage Society was registered as a charity on 1 January 2011 when some retired persons in Wimbledon contributed £72,200 for the purpose. The amount was placed in a bank and recorded as an Accumulated fund. The following is a summary of the activities in the year ended 31 December 2011:

1. On 1 January it acquired its own premises for £420,000, receiving 75% of the amount as a grant from the London Borough of Merton. The Society attributes a third of the cost to land and proposes to depreciate the cost of the building at 2% p.a. using the straight-line method.

2. The London Borough of Merton has agreed also to support the activities of the Society, making an annual grant of £25,000. A cheque for that amount, received on 7 May 2011, was in respect of the Borough’s financial year ending on 31 March 2012.

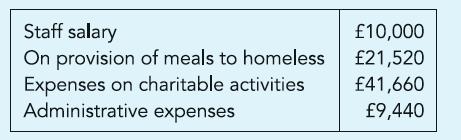

3. Donations and charitable contributions received during the year amount to £69,800; while the Society’s expenses are summarised on the right.

4. Salary is paid to the Administrative Secretary, appointed on 1 March 2011 at a salary of £1,000 per month. The Department of Social Welfare has agreed to bear 80% of the salary. A cheque for £9,600 was received from the Department in November 2011.

5. During the year the Society has provided 26,250 meals to homeless persons. Hunger Relief, another registered charity, has agreed to share this cost, at 50p per meal provided, and a cheque for £11,250 was received in December 2011.

Required:

Prepare

(a) The Statement of income of the Society for the year ending 31 December 2011, including in its Accumulated fund any surplus arising from its activities in the year;

(b) The Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict