The financial statements of Casserole plc, in respect of the year ending on 31 December 2011, are

Question:

The financial statements of Casserole plc, in respect of the year ending on 31 December 2011, are to be adopted by their board at a meeting scheduled for 7 May 2012. By a letter dated 15 April 2012 your advice is sought on how to account for the following transactions and events:

(a) Casserole plc has cancelled, with effect from 30.9.2011, a franchise it had granted to Pan Ltd in the Isle of Wight. Pan Ltd has filed action claiming liquidated damages in a sum of £300,000 and further punitive damages at £400,000. The legal opinion is that because Casserole plc did not have sufficient grounds for premature termination of franchise, it will be liable for the liquidated damages, and the award of any punitive damages depends on the attitude the court adopts.

(b) On 4 March 2012 Casserole plc received a claim for £250,000, in addition to £50,000 paid as compensation on terminating the services of a branch manager with effect from 30.11.2011. Because there were several instances of provable managerial inadequacies, the chance of the claim being enforced against the company is estimated at less than 5%.

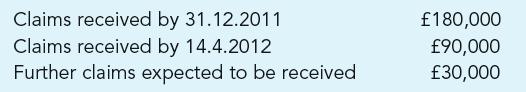

(c) A batch of goods sold in November/December 2011 has proved defective. Customers have as a result made claims for repayment as follows:

These goods had been sold at cost plus 25%, but have no value upon return. Casserole plc considers that it is possible to make a counter-claim against the supplier from whom they had acquired the goods.

(d) The company is currently subject to an investigation by the Director General of Fair Trading in respect of possible contravention of orders made by Restrictive Practices Court. Though the charges are strenuously contested and Casserole plc is doing its utmost to vindicate its trading practices, the legal advisers are unable to foresee the outcome. In the event the findings are adverse, damages awarded against the company may range from £100,000 to almost ten times that amount. The company is averse to admitting to such an investigation because of the damage it may cause to its reputation and is unwilling to account for any claim which may arise because that could amount to an admission of guilt.

Required:

In respect of each of the above claims, clarify whether the obligation to transfer future economic benefit should be accounted for either as liability or as a provision or disclosed in a note to the accounts as a contingent liability.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict