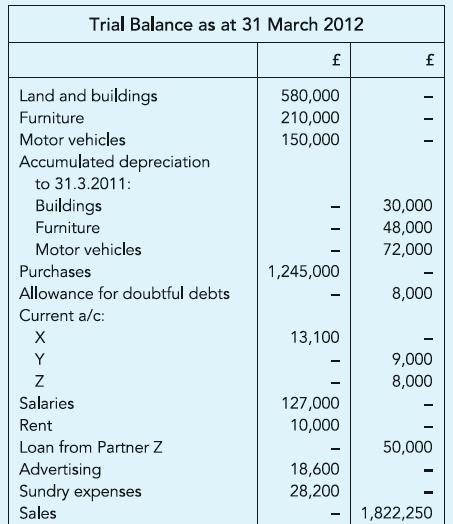

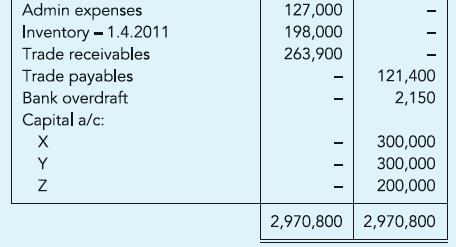

The year-end Trial Balance of a business run by X, Y and Z as partners is shown.

Question:

The year-end Trial Balance of a business run by X, Y and Z as partners is shown. The partnership agreement provides that:

■ X will receive a salary of £3,000 per month.

■ Interest will be allowed on fixed capital at 5% per annum.

■ Interest to be charged on drawings at 4% p.a.

■ X, Y and Z are to share profits and losses in the ratio 3:2:1 respectively.

Further information:

(i) Premises have been rented from Partner Y at £1,000 per month.

(ii) The cost of goods remaining unsold at the year-end is £248,000. £30,000 of these goods, however, are shop-soiled and can only be sold for £21,000 after reconditioning them at a cost of £5,000.

(iii) Salaries account includes the following:

– £30,000 taken as salary by partner X

– £15,000 drawn by partner Y on 1.7.2011

– £10,000 drawn by partner Z on 1.1.2012.

(iv) The loan of £50,000 was obtained from partner Z when the business commenced in 2006.

(v) Trade receivables of £3,900 should be written off and the Allowance for doubtful debts adjusted to cover 4% of remaining debts.

(vi) Land acquired at a cost of £200,000 is not to be depreciated. Buildings, furniture and vehicles are to be depreciated at 2%, 10% and 20% per annum respectively, on cost.

Required:

(a) The partners’ Current accounts in columnar format.

(b) the Statement of income for the year ended 31 March 2012 and the Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict