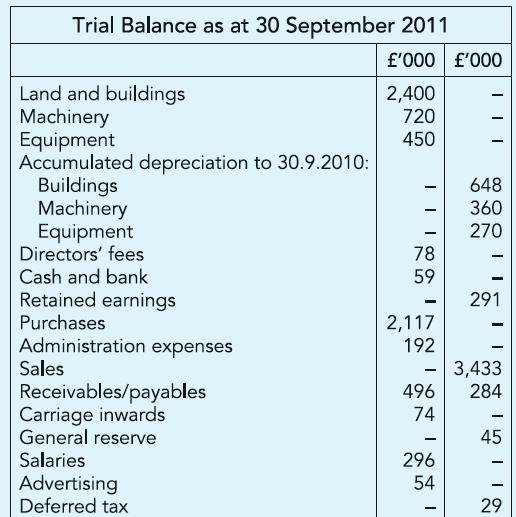

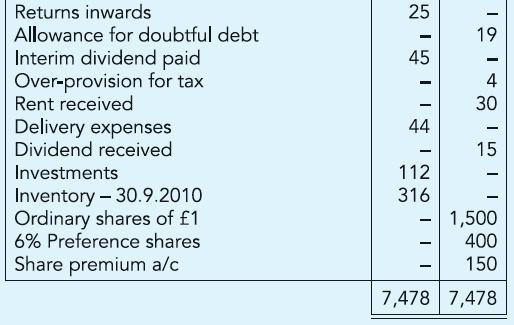

The year-end Trial Balance was extracted from the books of Sparrow Ltd as shown. You are informed

Question:

The year-end Trial Balance was extracted from the books of Sparrow Ltd as shown.

You are informed as follows:

(a) Included within sales are goods invoiced at £16,000 in respect of which the customers have the option to return until a week after the year-end. These goods were invoiced at cost plus a third.

(b) Cost of inventory held as at 30 September 2011 was £385,000.

(c) A portion of the shop premises has been let out, at £3,000 per month, since 2007.

(d) Buildings are depreciated at 2% of cost per annum assuming that a quarter of the cost related to land which is not depreciated. Directors wish to report land and buildings at their current value which was identified, as at 1 October 2010, as £1 million for land and £1.6 million for the buildings.

(e) New machinery was acquired for £80,000 on 1 April 2011. Machinery is depreciated at 10% per annum using the reducing balance method.

(f) Equipment acquired on 1 October 2008 is depreciated using the sum of the years’ digits method over five years.

(g) Tax on current year’s profit is estimated at £79,000. Deferred tax needs to be accounted for at 20% of taxable temporary difference which, as at 30 September 2011, is identified at an amount of £180,000.

Required:

Prepare for publication the Statement of income for the year ended 30 September 2011 and the Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict