Tom Kelaart, registered for VAT, is familiar with accounting for VAT and has extracted the year-end Trial

Question:

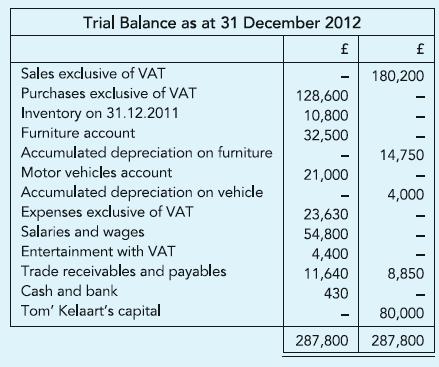

Tom Kelaart, registered for VAT, is familiar with accounting for VAT and has extracted the year-end Trial Balance as shown. He informs you that:

(a) Invoices received after 31 December 2012 confirm that VAT-inclusive prices of £21,150 and £4,935 remain unpaid in respect of furniture (delivered on 1 October 2012) and goods for sale (delivered on 29 December 2012). These are yet to be accounted for.

(b) In addition December salary amounting to £4,500 remains unpaid.

(c) Inventory conducted on 31 December 2012 reveals the cost (inclusive of VAT) of goods in hand to be £17,390. However, goods taken by Tom for his own use have not been accounted for. The cost of these goods, inclusive of VAT, was £4,700.

(d) Furniture is depreciated at 10% per annum using the reducing balance method and vehicles at 20% per annum on cost. Depreciation is time apportioned for the nearest months of use.

(e) Tom wishes to set up an Allowance for doubtful debts at 5% of trade receivables.

(f) The VAT rate is 17.5%.

Required: Prepare the Statement of income for the year ended 31 December 2012 and the Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict