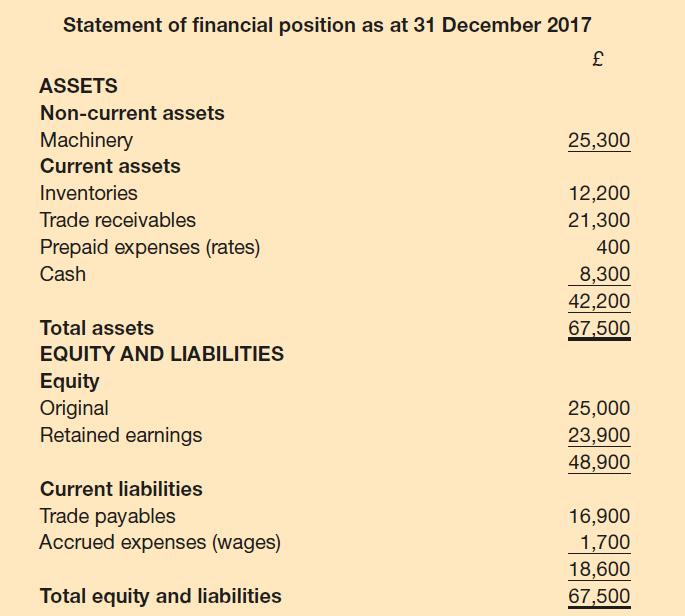

The following is the statement of financial position of WW Associates as at 31 December 2017: 1.

Question:

The following is the statement of financial position of WW Associates as at 31 December 2017:

1. The owners withdrew £23,000 of equity in cash.

2. Premises were rented at an annual rental of £20,000. During the year, rent of £25,000 was paid to the owner of the premises.

3. Rates on the premises were paid during the year for the period 1 April 2018 to 31 March 2019 and amounted to £2,000.

4. Some machinery (a non-current asset), which was bought on 1 January 2017 for £13,000, has proved to be unsatisfactory. It was part-exchanged for some new machinery on 1 January 2018 and WW Associates paid a cash amount of £6,000. The new machinery would have cost £15,000 had the business bought it without the trade-in.

5. Wages totalling £23,800 were paid during the year. At the end of the year, the business owed £860 of wages.

6. Electricity bills for the four quarters of the year were paid totalling £2,700.

7. Inventories totalling £143,000 were bought on credit.

8. Inventories totalling £12,000 were bought for cash.

9. Sales revenue on credit totalled £211,000 (cost £127,000).

10. Cash sales revenue totalled £42,000 (cost £25,000).

11. Receipts from trade receivables totalled £198,000.

12. Payments to trade payables totalled £156,000.

13. Van running expenses paid totalled £17,500.

The business uses the reducing-balance method of depreciation for non-current assets at the rate of 30 per cent each year.

Required:

Prepare an income statement for the year ended 31 December 2018 and a statement of financial position as at that date.

Step by Step Answer:

Financial Accounting For Decision Makers

ISBN: 9781292251257

9th Edition

Authors: Peter Atrill, Eddie McLaney