After an intense period of negotiation, Global Enterprises Corporation TA 2, 3 agreed to purchase all of

Question:

After an intense period of negotiation, Global Enterprises Corporation TA 2, 3 agreed to purchase all of the outstanding common shares of The Carlton Corporation. The agreed-upon price was \($294\) million, payable in Global Enterprise shares. According to the agreement, Global Enterprises would issue one share of its common stock in exchange for each share of The Carlton Corporation.

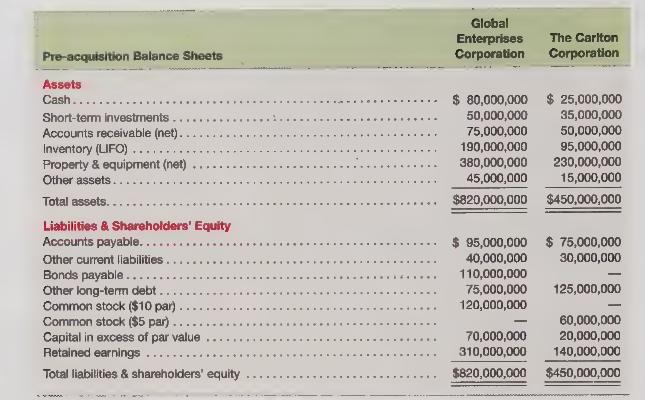

Following the exchange, The Carlton Corporation would become a wholiy-owned subsidiary of Global Enterprises. At the time of the negotiations, the market price of Global Enterprises’ shares was \($24.50\) per share. Presented below are the pre-acquisition balance sheets of Global Enterprises and The Carlton Corporation:

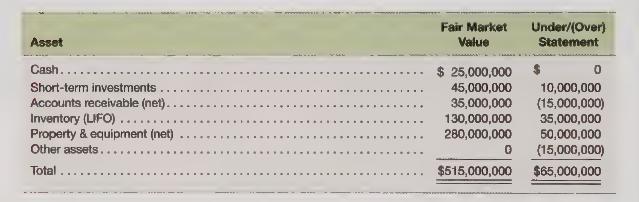

As part of Global Enterprises’ due diligence, the company determined that while the liabilities of The Carlton Corporation were fairly valued, some of the company’s assets were not fairly valued. The fair value of Carlton’s assets were as follows:

Required

Prepare the consolidated balance sheet immediately following the acquisition using consolidation accounting,

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris