Consider a publicly-held company whose products you are familiar with. Some examples might include: Access the companys

Question:

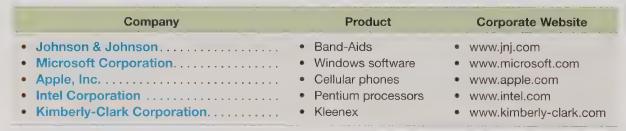

Consider a publicly-held company whose products you are familiar with. Some examples might include:

Access the company’s public website and search for its most recent annual report. (Note: Some companies will provide access to their financial data through an “investor relations” link, while others will provide a direct link to their “annual reports.”) After locating your company’s most recent annual report, open the file and review its contents. After reviewing the annual report for your selected company, prepare answers to the following questions:

a. Identify the company’s basic and diluted earnings per share (EPS) for the past two years. Is there a difference between these EPS numbers? If so, what dilutive claims are responsible for the decline in basic earnings per share?

b. Review the company’s income statement. Are there any extraordinary or special items, restructuring charges, changes in accounting principles, or discontinued operations in either of the last two years? If so, calculate the company’s sustainable earnings for each year.

c. Consider the company’s statement of cash flow. What format— indirect or direct—is used to present the cash flow from operations? Convert the company’s cash flow from operations from the indirect (direct) format to the direct (indirect) format.

d. Calculate the company’s EBITDA, free cash flow, and discretionary cash flow for each of the past two years. Comment on the company’s cash flow health.

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris