Mulligan Co. purchased a new machine on January 1. The following information pertains to the purchase: Required

Question:

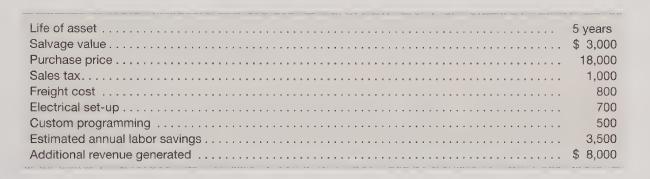

Mulligan Co. purchased a new machine on January 1. The following information pertains to the purchase:

Required

a. Determine the capitalized cost of the new machine

b. Compute annual depreciation, accumulated depreciation, and the machine’s book value for the first three years assuming i. Straight-line depreciation ii. Double-declining-balance method

c. Assume the machine is sold for \($8,000\) at the end of the third year after depreciation has been calculated.

Determine the gain or loss assuming i. Straight-line depreciation ii. Double-declining-balance method

d. Given your answer in part c, if Mulligan was able to perfectly predict the future that the machine would be sold for \($8,000\) at the end of the third year, which depreciation method should Mulligan choose?

Ignore taxes.

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris