Presented below are the condensed financial statements of Global Enterprises, Inc. The companys inventory is valued using

Question:

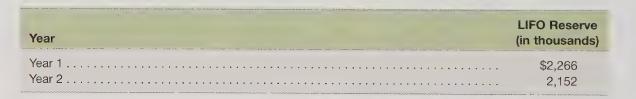

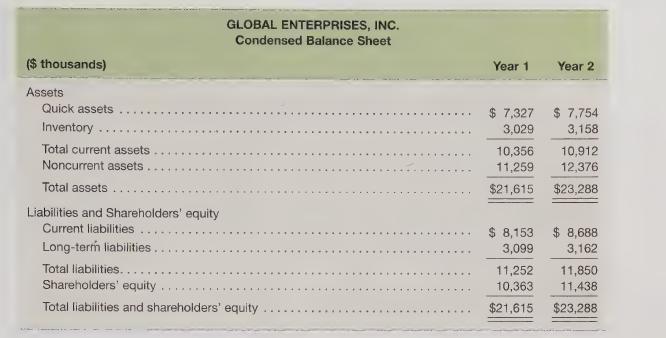

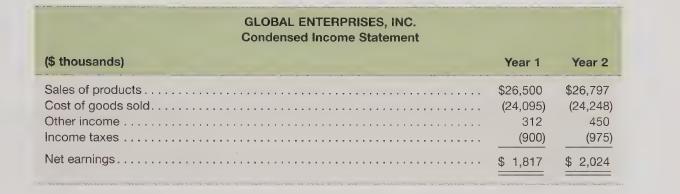

Presented below are the condensed financial statements of Global Enterprises, Inc. The company’s inventory is valued using LIFO. The company’s footnotes reveal that the LIFO reserve was as follows.

Also, the footnotes indicate that net reductions in inventory levels resulted in a liquidation of LIFO layers amounting to \($163,000\) in Year 1 and \($114,000\) in Year 2.

Required

1. Restate the company’s financial statements for Year 2 assuming the use of FIFO instead of LIFO.

2. Compare the tax consequences of using LIFO versus FIFO in Year 2, and for all prior years. (Assume an effective tax rate of 33 percent.)

3. Which method—FIFO or LIFO—should Global Enterprises use for reporting its financial results to shareholders?

Why?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris