The Arcadia Company made an offer to purchase all of the outstanding shares of The Claremont Company

Question:

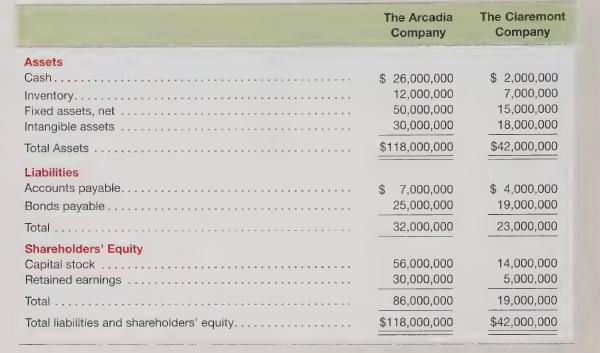

The Arcadia Company made an offer to purchase all of the outstanding shares of The Claremont Company at a price of \($10\) per share, or an aggregate of \($22\) million. Immediately prior to the purchase offer, the balance sheets of the two companies guia. as follows:

During its due diligence review, Arcadia determined that while the liabilities of The Claremont Company were fairly valued, the reported value of Claremont’s inventory was understated by \($1,000,000\) as a consequence of using the LIFO method, and the intangible assets of The Claremont Company were overstated by \($4,000,000\) because an impairment in the value of certain intangible assets had not yet been recorded in the company’s financial statements.

Required

a. Calculate the value of the goodwill implicit in the offer price of \($22\) million.

b. Prepare the unconsolidated balance sheet of The Arcadia Company immediately following a successful acquisition of 100 percent of the outstanding shares of The Claremont Company.

c. Prepare the consolidated balance sheet for The Arcadia-Claremont Company assuming a successful acquisition offer.

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris