The Claremont Corporation invests its excess cash in low-risk, dividend-paying equity securities until such funds are needed

Question:

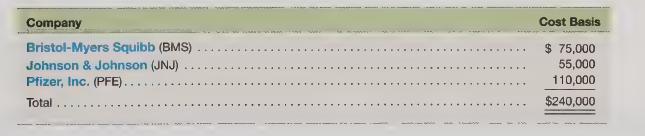

The Claremont Corporation invests its excess cash in low-risk, dividend-paying equity securities until such funds are needed to support operations. At the beginning of the year, the company’s portfolio consisted of the following securities:

At year-end, the fair values of the three securities were as follows: BMS $82,000; JNJ $53,000; and PFE \($100,000\). Calculate the income statement effect of the company’s short-term investments assuming:

(a) all securities are classified as trading;

(b) all securities are classified as available-for-sale; and

(c) BMS and JNJ are classified as trading, while PFE is classified as available-for-sale.

Does the classification of a security as trading versus available-for-sale affect a company’s reported earnings? Will it affect the value of a company’s share price? Will it affect the amount of income taxes that a company pays to the Internal Revenue Service?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris