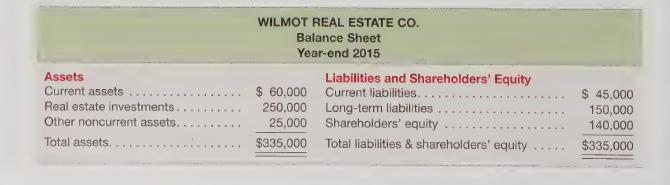

Wilmot Real Estate Co. had the following balance sheet at year-end 2015: In early 2016, the company

Question:

Wilmot Real Estate Co. had the following balance sheet at year-end 2015:

In early 2016, the company took out a \($200,000\) two-year bank loan to finance new real estate investments. The loan specified that Wilmot must maintain a current ratio of at least 2-to-1 at all times during the loan period.

Failure to satisfy this debt covenant would represent a “technical default” of the loan agreement, enabling the bank to demand immediate repayment of the outstanding loan balance and any accrued interest.

During 2016, Wilmot experienced the following events:

1. Generated \($750,000\) in revenues, of which \($700,000\) was collected by year-end 2016.

2. Incurred \($650,000\) in expenses, of which \($575,000\) was paid in cash.

Required

1. Prepare a balance sheet at year-end 2016 assuming that Wilmot invested the maximum allowable amount of the bank loan in new real estate investments in early 2016.

2. Evaluate Wilmot’s compliance with the current ratio debt covenant assuming

(a) the bank loan is included in current liabilities and

(b) the bank loan is included in long-term liabilities.

3. Calculate the maximum dividend that Wilmot can distribute to its shareholders in 2016 assuming the bank loan is included in long-term liabilities.

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris