In January 2018, Mitzu Co. pays $2,600,000 for a tract of land with two buildings on it.

Question:

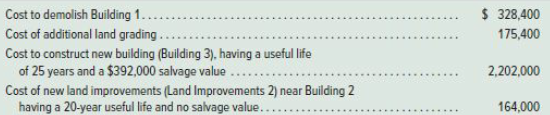

In January 2018, Mitzu Co. pays $2,600,000 for a tract of land with two buildings on it. It plans to demolish Building 1 and build a new store in its place. Building 2 will be a company office; it is appraised at $644,000, with a useful life of 20 years and a $60,000 salvage value. A lighted parking lot near Building 1 has improvements (Land Improvements 1) valued at $420,000 that are expected to last another 12 years with no salvage value. Without the buildings and improvements, the tract of land is valued at $1,736,000. The company also incurs the following additional costs:

Required

1. Prepare a table with the following column headings: Land, Building 2, Building 3, Land Improvements 1, and Land Improvements 2. Allocate the costs incurred by Mitzu to the appropriate columns and total each column (round percents to the nearest 1%).

2. Prepare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1, 2018.

3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the 12 months of 2018 when these assets were in use.

Step by Step Answer:

Financial Accounting Information for Decisions

ISBN: 978-1259917042

9th edition

Authors: John J. Wild