Refer to the opening feature about Build-ABear Workshop and its founder Maxine Clark. Assume the business reports

Question:

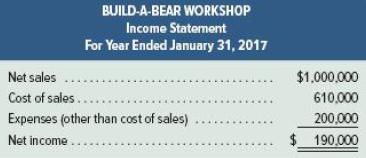

Refer to the opening feature about Build-ABear Workshop and its founder Maxine Clark. Assume the business reports current annual sales at approximately $1 million and prepares the following income statement.

Assume the business sells to individuals and retailers, ranging from small shops to large chains. Assume that they currently offer credit terms of 1/15, n/60, and ship FOB destination. To improve their cash flow, they are considering changing credit terms to 3/10, n/30. In addition, they propose to change shipping terms to FOB shipping point. They expect that the increase in discount rate will increase net sales by 9%, but the gross margin ratio (and ratio of cost of sales divided by net sales) is expected to remain unchanged. They also expect that delivery expenses will be zero under this proposal; thus, expenses other than cost of sales are expected to increase only 6%.

Required

1. Prepare a forecasted income statement for the year ended January 31, 2018, based on the proposal.

2. Based on the forecasted income statement alone (from your part 1 solution), do you recommend that the business implement the new sales policies? Explain.

3. What else should the business consider before deciding whether or not to implement the new policies? Explain.

Discount RateDepending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

Financial Accounting Information for Decisions

ISBN: 978-1259917042

9th edition

Authors: John J. Wild