Pat, a rational investor, has $5,000 to invest for one year, pending a large purchase. She has

Question:

Pat, a rational investor, has $5,000 to invest for one year, pending a large purchase. She has narrowed her choice down to two investments. One (a1) is to invest the full amount in shares of Company X. The other (a2) is to buy risk-free government bonds yielding an annual return of 4.5 percent. Company X has little debt and its stock is low-beta.

Pat identifies two states of nature:

State H: Company X performs well.

State L: Company X performs poorly.

Pat searches the Internet for financial information about X Ltd. Based on this evidence, she assesses the following subjective prior state probabilities:

State H: 0.3

State l: 0.7

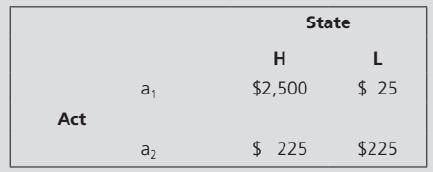

The following is the payoff tab le for these two investments. Payoffs from X Ltd. shares consist of dividends and capital gain for the year. Amounts are estimated based on past performance of X ltd., and are net of the original investment.

Pat is risk-averse, with utility equal to the square root of the net dollar payoff.

Required

a. On the basis of her prior probabilities, which action should Pat take? Show calculations.

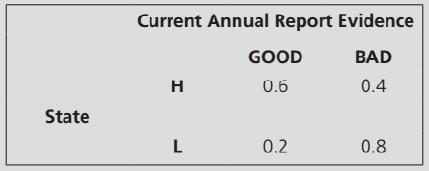

b. Instead o f acting now, Pat decides to obtain more information about Company X by consulting a financial advisor. The advisor, who claims to be familiar with GAAP. advises Pat that the quality of X Ltd.'s financial statements prepared under current GAAP can be represented by the following information system:

Upon reading the X Ltd.'s most recent annual report, the advisor tells Pat that performance is Bad. Which act should Pat take now? Show calculations.

c. Shortly after Pat makes her decision in b, she is surprised to note that despite the bad performance described by the advisor, the market price of X Ltd. shares rises significantly. Pat asks the advisor how this could happen. The advisor replies that favourable economy-wide events occurring after the financial statements were issued were the reason for the share price increase. Do you agree? Explain why or why not.

d . Pat suspects that t he advisor did not study X Ltd.'s annual report carefully enough, and decides to investigate herself. She turns to theoretical and empirical studies of rational, risk-averse investors and an efficient securities market, and to market response to financial statement information, to help understand why the market seems to have responded positively following X Ltd.'s annual report, even though the financial statements showed bad news. Suggest, and briefly explain, possible reasons for the positive market response.

Step by Step Answer:

Financial Accounting Theory

ISBN: 9780134166681

8th Edition

Authors: William R. Scott, Patricia O'Brien