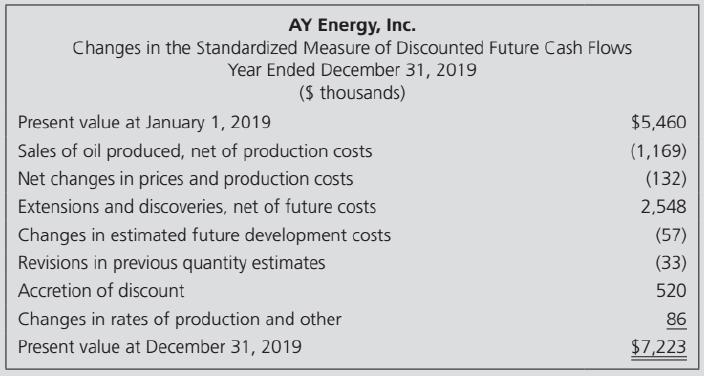

The following RRA information is taken from the December 31, 2019, annual report of AY Energy, Inc.

Question:

The following RRA information is taken from the December 31, 2019, annual report of AY Energy, Inc.

Required

a. Prepare an RRA income statement for AY Energy for 2019.

b. AY Energy reports elsewhere in its annual report an (historical cost-based) operating loss from exploration and production for 2019 of $5,389. While this amount may exclude certain administrative cost allocations, take this operating loss as a reasonable historical cost-based analogue of the RRA income you calculated in part a. Explain why RRA income for 2019 is different from the $5,389 loss under historical cost.

c . The standardized measure is applied only to proved reserves under RRA, using average oil and gas prices for the year. Explain why.

d. RRA mandates a discount rate of 10 percent for the RRA present value calculations, rather than allowing each firm to choose its own rate. Why? Can you see any disadvantages to mandating a common discount rate?

Step by Step Answer:

Financial Accounting Theory

ISBN: 9780134166681

8th Edition

Authors: William R. Scott, Patricia O'Brien